Newsletter

Weekly fundamentals – Incentives fueling growth across the board

Token Terminal Research

•

📊 New listings

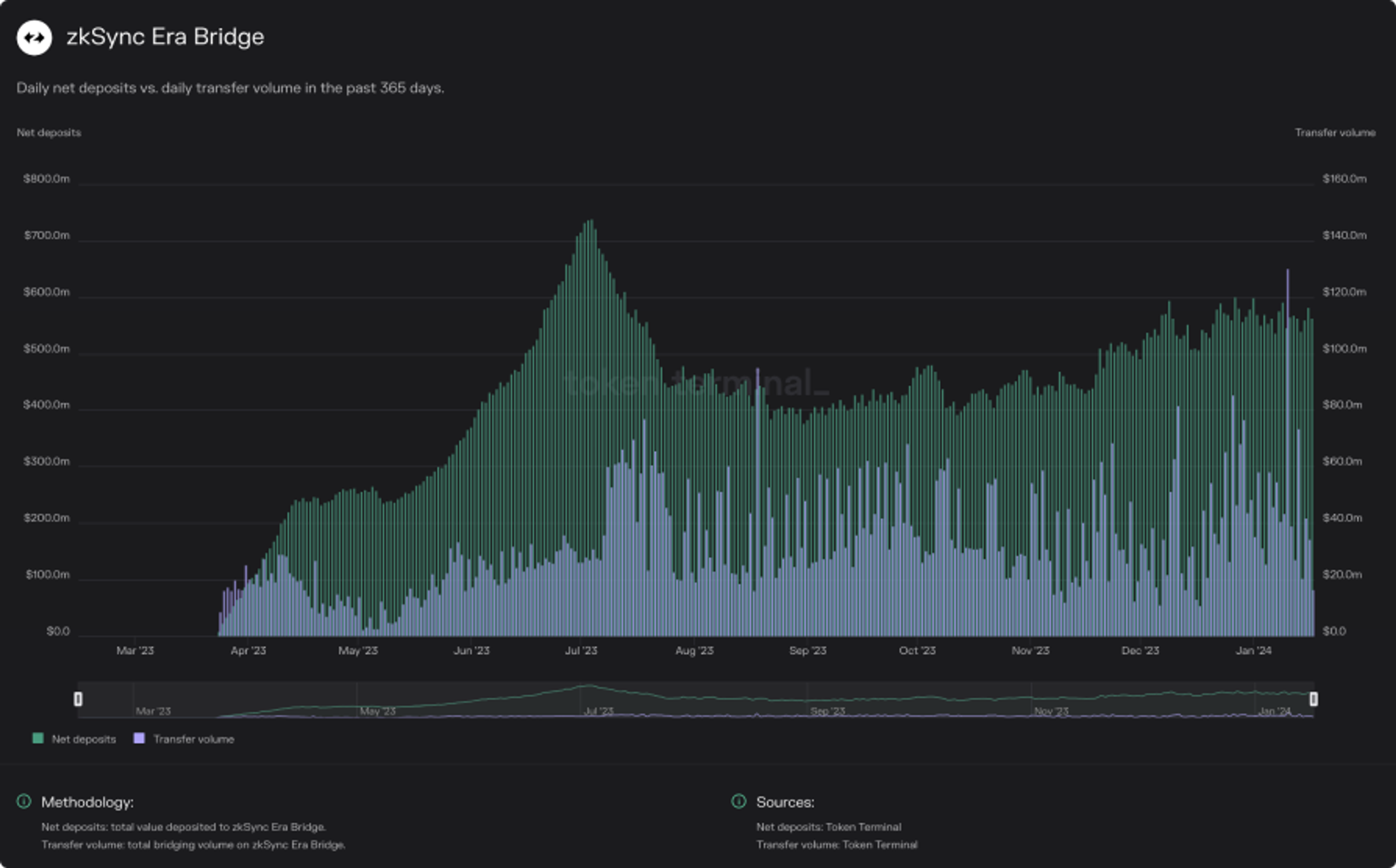

zkSync Era Bridge – an asset bridge built on Ethereum and zkSync Era.

Users deposit and lock assets on Ethereum in exchange for an equivalent amount of a corresponding token on zkSync Era. Conversely, users can withdraw assets from zkSync Era in exchange for the same amount on Ethereum.

- zkSync Era mainnet launched in March '23. The peak in net deposits on the zkSync Era Bridge in July '23, exceeding $800 million, was driven by a surge in onchain activity, following the network's successful launch in March '23.

- Between 100k and 700k users have been onboarded to zkSync Era each month since March '23. Daily transfer volume has shown an increasing trend, with several spikes surpassing $100 million. This suggests growing user interest in bridging assets to zkSync Era, which is in line with the findings we shared in last week's research piece.

👓 Insights from Token Terminal research

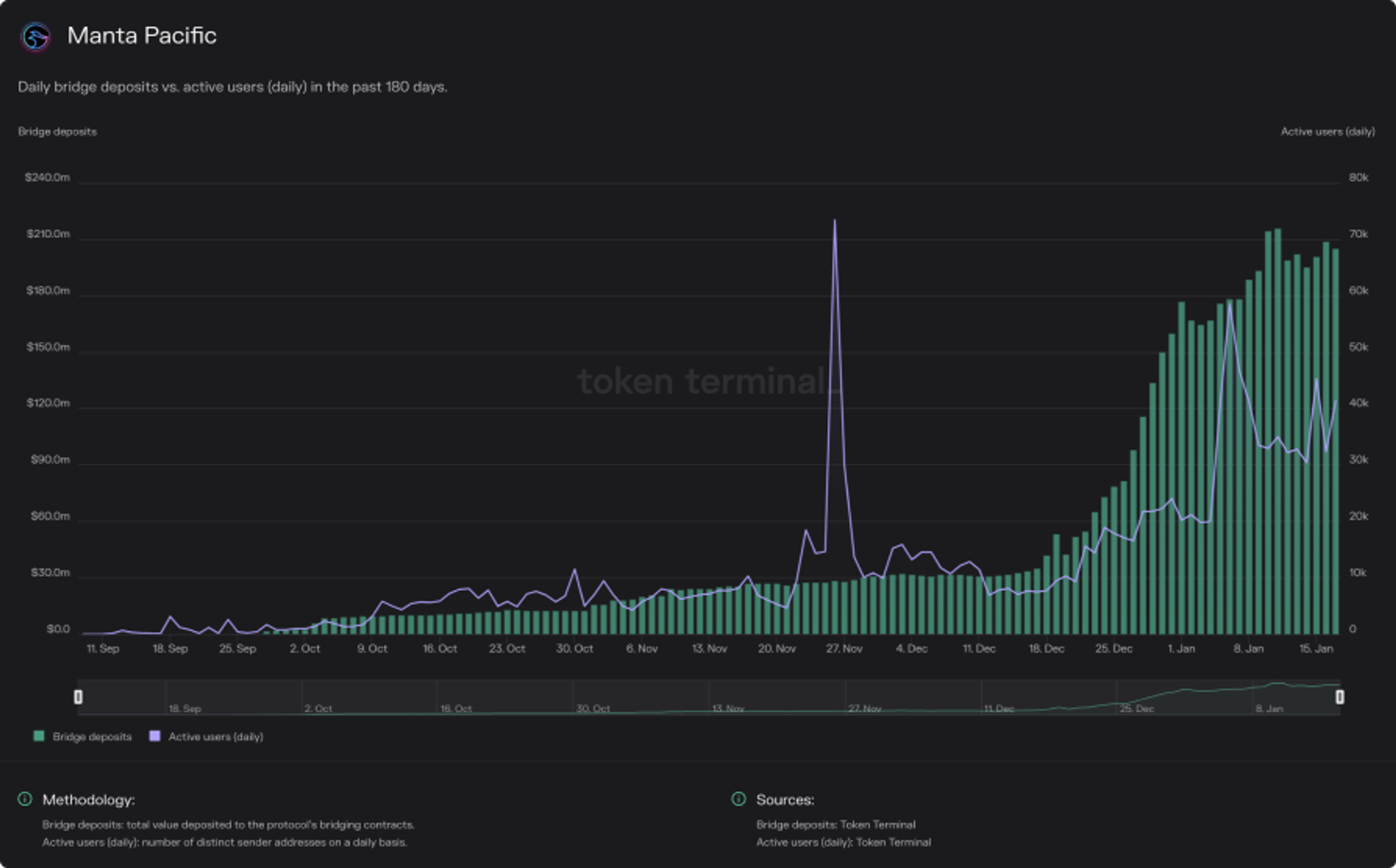

Surge in Manta Pacific's bridge deposits

The total value deposited to Manta Pacific's bridging contracts is up 390% over the past 30 days. The above chart shows a surge in bridge deposits beginning halfway through December '23, growing exponentially to over $200 million today. The daily active users (DAU) count has also followed this trend, with an outlier spike in late November '23, peaking at over 73K.

Manta's New Paradigm program is driving growth through incentives. Manta offers depositors 4-5% native yields on Ethereum and USDC through staking ETH and US Treasury Bonds. Depositors also receive 'receipt tokens' for use within the Manta ecosystem, options for re-staking ETH via EigenLayer, and an airdrop of the MANTA token.

November's user activity spike linked to the MantaFest Treasure Cruise event. This onchain event, which spanned from November 22nd to December 21st, promoted user interaction through point claims and NFT collections.

Robust user growth reflects an effective growth strategy. While this activity can mainly be attributed to speculative airdrop farming, the data points to a successful user engagement campaign. It remains to be seen how sticky this userbase ends up being post airdrop. It's worth keeping an eye on the retention rates for monthly active user (MAU) cohorts, below, to track this development.

Why fundamental analysis™ will become the norm in crypto

Hint: it's because of economic incentives.

- The best investors realize the market opportunity present in investing in Internet-scale businesses.

- To raise money from limited partners today, asset managers need to show that the investment targets are not purely speculative.

- As a result, the asset manager community will start to ask for standardized and comparable financial reporting from the protocols (in their portfolio).

- That's where platforms like Token Terminal step in to assist both investors and protocols in making TradFi-style stakeholder reporting available at scale.

Excerpt from Pantera Capital's article: Emerging Catalysts in Crypto

Crypto industry parallels to maturity in equities

"The main prong of our thesis is that digital asset prices will increasingly trade on fundamentals. We believe the rules that apply in traditional finance will also apply here. There are now many protocols with real revenue and product market fit attracting loyal customers. And now there are an increasing number of investors with this fundamentals lens that are applying traditional valuation frameworks to price these assets...

...In our view, as the industry matures, the next trillion dollars that are coming into this space will be from institutional asset allocators trained in these fundamental valuation techniques. By investing with those frameworks today, we believe we are positioned ahead of that secular trend."

- Cosmo Jiang, Portfolio Manager at Pantera Capital.

📣 Insights from our community

Episode 9 of The Rundown is live!

— Michael Nadeau | The DeFi Report (@JustDeauIt) January 12, 2024

This week we go onchain to assess how @zksync became the fastest-growing L2 in the Ethereum ecosystem.

Using data powered by @tokenterminal we break down everything you need to know about zkSyncs economics and growing network effects.

We hope… pic.twitter.com/VUkHJZ0LNo

In the lead for weekly cumulative fees in the bridges sector is @AcrossProtocol.

— Blockstar (@blockstar_adv) January 15, 2024

Accumulating $92.3K in fees only to be followed by @StargateFinance with $85.9K in fees.

Data: @tokenterminal pic.twitter.com/IiB45gjIbF

Explore Terminal Pro: https://tokenterminal.com/product/pro

🔌 Terminal API

You can now retrieve available market sectors through the Terminal API:

- Get a list of all market sectors: Use this endpoint to retrieve a list of all available market sectors.

- Market sector data: Use this endpoint to retrieve market sector metadata and the list of all projects belonging to a market sector.

Market sectors can now also be used to filter the following datasets:

If you have questions about our API or are interested in obtaining trial access, please reach out to people@tokenterminal.xyz.

📂 Data Room

Handpicked insights from the Token Terminal Data Room

MakerDAO's Direct Deposit Module (D3M)

The Direct Deposit Module (D3M) integrates MakerDAO with third-party lending protocols. This enables MakerDAO to set a cap on the variable borrow rate for the DAI market within each respective lending protocol.

Spark D3M's substantial contribution to MakerDAO's interest revenue. Since its inception in May '23, the Spark D3M has significantly enhanced MakerDAO's financials. It has generated a total of $7.6 million in interest revenue, with $1.7 million accrued year-to-date, accounting for more than 16% of MakerDAO's total interest revenues.

Spark boosts DAI Liquidity. Introduced by MakerDAO with a mission to empower the DAI ecosystem, Spark allows direct deposits of DAI into its lending market, earning interest from borrowers. The platform's appeal is amplified by speculative airdrop farming and third-party incentives, leading to a significant rise in user engagement. Currently, with $807 million in outstanding DAI, Spark stands as the largest source of DAI after Monetalis Clydesdale and BlockTower Andromeda Real World Asset vaults.

The success of Spark highlights the effectiveness of D3M as a tool for generating revenue and driving DAI adoption. It reflects market confidence in the product and suggests potential for expansion and replication with other protocols.

Raw and decoded onchain data from 14 chains, accessible via Google BigQuery. Explore our Data Room offering: https://tokenterminal.com/product/data-room

📈 Trending contracts

Top 15 trending contracts by 30-day transactions

Tron continues to solidify stablecoin superiority. USDT transactions on Tron hit 51.33 million over the past 30 days, outperforming BNB Chain and Ethereum, where USDT transactions are only 36% and 6% of Tron's volume, respectively. This activity constitutes a dominant 92.5% share of all gas consumed on Tron, raising the question: will Tron be able to expand its network's use cases beyond stablecoins? For reference, USDT's share of the gas market is 3.9% on the BNB Chain, and 4.7% on Ethereum – almost the inverse of the situation on Tron.

The Ronin ecosystem is heating up. Ronin is an EVM-compatible blockchain (L1) launched by Sky Mavis in February '21. As of today (18.1.2024), Ronin blockchain's DAUs soared to 608K, levels not seen since December '21. Ronin's growth is being driven by several advancements within its gaming hub, particularly from Pixels (a social farming simulation game) and Apeiron (a card game), both of which have announced upcoming token airdrops.

Over the past 30 days, the most transacted contract on Ronin was CARV, with 5.97 million transactions from 1.73 million active users. CARV is developing an intent-centric, self-sovereign identity (SSI) oracle, an incentivized data exchange and service protocol, and an AI-powered super app, initially focusing on gaming. It allows users to manage and monetize their data while providing brands with ethically sourced, high-quality data.

zkSync Era is the clear leader in the blockchains (L2) market sector, with two contracts in the top 15 by 30-day transactions. SyncSwap and Circle's USDC on zkSync Era have established a strong foothold, despite zkSync Era only having been live on mainnet for 10 months.

New listings

New dApps live on Project contracts with full contract lists and key activity metrics:

- Term Finance – a lending protocol on Ethereum.

- zkSwap Finance – a non-custodial Swap-to-Earn DeFi exchange protocol built on zkSync Era.

- HMX – a non-custodial exchange for perpetual contracts built on Arbitrum.

- DLN – a cross-chain token bridge and trading infrastructure that enables the transfer of assets across blockchains.

Recently added EVM-based chains live on Trending contracts and Trending Wallets, with key metrics available for the top 1000 most active accounts:

Explore the Trending contracts metric glossary here.

ICYMI

Fundamentals podcast

Research

Explore the Terminal: https://tokenterminal.com/terminal

The authors of this content, or members, affiliates, or stakeholders of Token Terminal may be participating or are invested in protocols or tokens mentioned herein. The foregoing statement acts as a disclosure of potential conflicts of interest and is not a recommendation to purchase or invest in any token or participate in any protocol. Token Terminal does not recommend any particular course of action in relation to any token or protocol. The content herein is meant purely for educational and informational purposes only, and should not be relied upon as financial, investment, legal, tax or any other professional or other advice. None of the content and information herein is presented to induce or to attempt to induce any reader or other person to buy, sell or hold any token or participate in any protocol or enter into, or offer to enter into, any agreement for or with a view to buying or selling any token or participating in any protocol. Statements made herein (including statements of opinion, if any) are wholly generic and not tailored to take into account the personal needs and unique circumstances of any reader or any other person. Readers are strongly urged to exercise caution and have regard to their own personal needs and circumstances before making any decision to buy or sell any token or participate in any protocol. Observations and views expressed herein may be changed by Token Terminal at any time without notice. Token Terminal accepts no liability whatsoever for any losses or liabilities arising from the use of or reliance on any of this content.

Stay in the loop

Join our mailing list to get the latest insights!

Continue reading

Customer stories: Token Terminal’s Data Partnership with Linea

Through its partnership with Token Terminal, Linea turns transparency into a competitive advantage and continues to build trust with its growing community.

Introducing Tokenized Assets

Token Terminal is expanding its standardized onchain analytics to cover the rapidly growing category of tokenized real-world assets (RWAs) – starting with stablecoins, tokenized funds, and tokenized stocks.

Customer stories: Token Terminal’s Data Partnership with EigenCloud

Through its partnership with Token Terminal, EigenCloud turns transparency into a competitive advantage and continues to build trust with its growing community.