Newsletter

Crypto fundamentals – Charts and trends to watch

A walkthrough of the most interesting charts and trends in crypto, with a focus on key business drivers and protocol fundamentals.

This week’s newsletter focuses on the blockchains (L1) market sector, which has a designated dashboard on Token Terminal. Let’s dig in!

Blockchains (L1) are smart contract execution environments that allow for the permissionless creation of smart contract-based businesses or DAOs.

Introduction

- Blockchains provide infrastructure for the coordination of economic activity. Blockchains are open-source platforms that are globally accessible and auditable 24/7. They provide a predictable ruleset for both themselves and the businesses that choose to operate on them. Blockchains typically generate revenue by taking a cut of the transaction fees paid by users. Read our newsletter on blockchain economics to learn more about how blockchains generate fees.

- Blockchains allow businesses to launch transparently and access a global user base from day one. The time and money it takes to incorporate traditional businesses varies greatly between countries and jurisdictions. It is often extremely time-consuming and costly to sell products and services across borders. Blockchains enable businesses to have seamless access to global capital markets, global participation from contributors and customers, transparent and highly automated rules of operation, and an immutable audit trail.

- Blockchain usage has come to be dominated by smart contract execution platforms such as Ethereum, rather than store-of-value platforms like Bitcoin. The blockchain market sector was initially dominated by Bitcoin, an extremely simple and limited contract execution environment. With the launch of Ethereum, it became possible to (in theory) deploy arbitrarily complex contracts or programs on a blockchain. Now, with the rise of scaling solutions, application-specific blockchains (app chains), and cross-chain bridges, it has become possible to deploy arbitrarily complex contracts also in practice.

Overview

The daily fees of the top 20 projects in the blockchains (L1) market sector since the beginning of the year are visualized below.

Scope of analysis

- The blockchains (L1) dashboard features 33 projects. There are numerous blockchains (L1) not yet listed on Token Terminal, so the dashboard can only give an indicative analysis of the market sector.

- Fees have been on an uptrend year-to-date (YTD), with aggregated monthly fees peaking at $692m in May. The current market leaders based on fees generated are Ethereum and Tron, representing approximately 60% and 25% market share in fees, respectively.

- The main drivers have been an increase in asset prices and a growing number of onchain transactions. Since the beginning of the year, the prices of Bitcoin and Ethereum have risen from 16k and 1.2k to 29k and 1.8k, respectively. In addition, transaction counts have also been on an uptrend over this period. The aggregated number of transactions across major EVM chains grew from 148m in January to 198m in July. These complementary factors resulted in a larger value of native assets being paid as fees to blockchain miners and validators.

- As onchain decentralized application (dapp) ecosystems continue to mature, we anticipate fees paid on blockchains to trend even higher. Transaction activity on blockchains is largely driven by the attractiveness of the dapp ecosystem built on top of it. Since 2020, we have seen new dapp market sectors flourish, including onchain gaming, derivatives trading, and more. As new and diverse applications continue to deploy onchain, we expect blockchain usage and fees to trend upward over time.

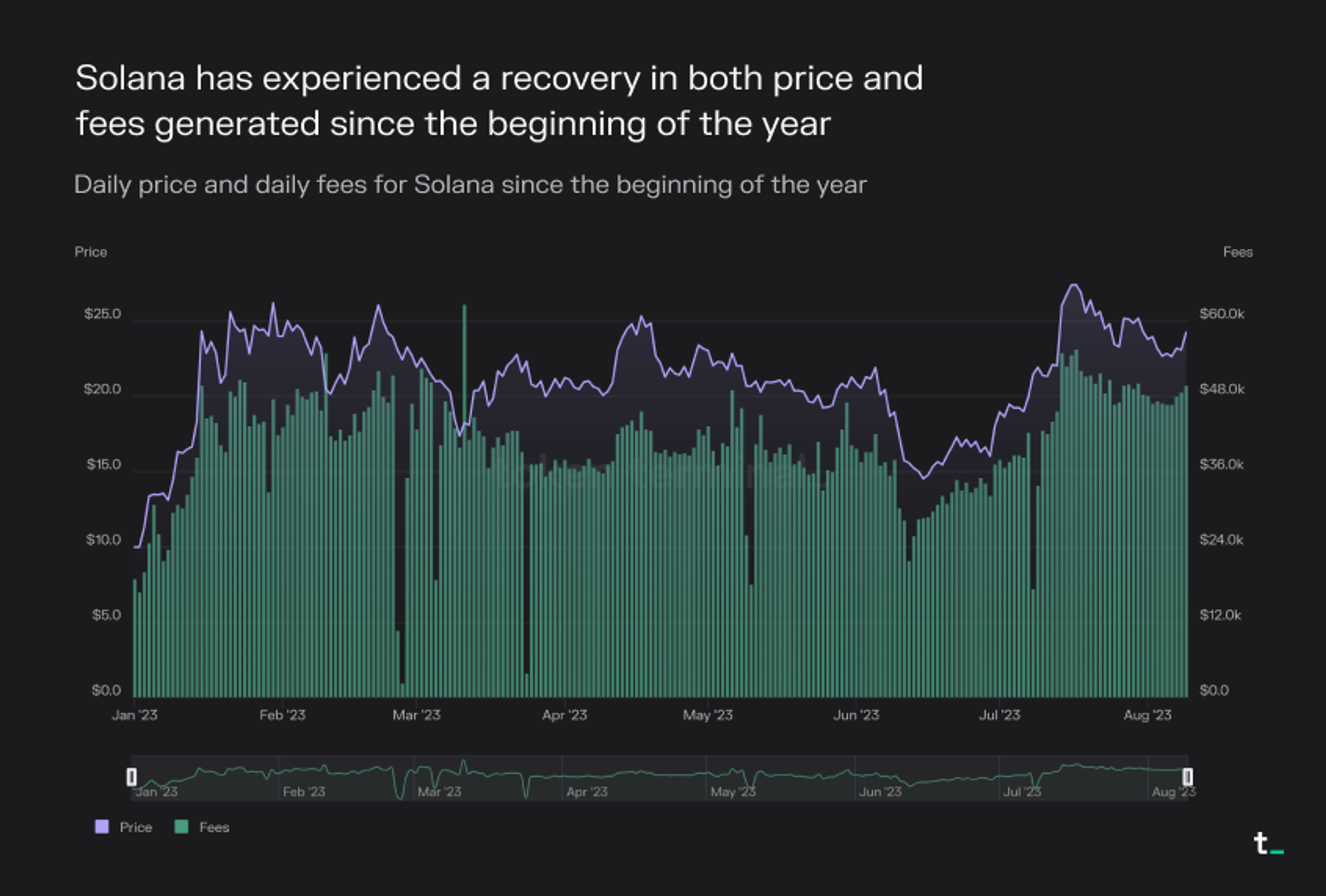

Solana has experienced a recovery in both price and fees generated since the beginning of the year

- Solana is seeing positive price action paired with an upwards surge in fees. The price of SOL has risen from $10 to $23.1 YTD (+131%). Furthermore, daily fees have increased from $18.9k to $48.7k (+157%) over the same period.

- Solana is attracting new developmental activity. Solana recently introduced Solang, allowing developers to write smart contracts (called “programs”) in Solidity, rather than Rust. This allows developers from EVM chains (such as Ethereum) to also deploy their apps on Solana without learning a new language. Solana's focus on composability has made it a popular platform for new dapp deployments, with the blockchain now host to notable protocols such as Marinade Finance, Jito, Orca, and more. In addition, some DePIN (Decentralised Physical Infrastructure Network) projects such as Helium and Hive Mapper have also migrated to Solana.

- We anticipate Solana to continue attracting new users and developers. Solana has had a difficult year due to several unfortunate events, including the fall of FTX (a major investor and supporter of the Solana ecosystem) and the SEC labeling SOL a security. Despite these challenges, development on top of Solana has not slowed. One of the most notable upcoming developments is Jump Crypto’s Firedancer, a new Solana validator client that aims to improve the network’s throughput, resilience, and efficiency.

LayerZero is the top gas-consuming project on Avalanche, Gnosis, and Fantom

- Interchain communication protocol LayerZero is among the top gas consumers on EVM blockchains (L1). LayerZero’s contracts consumed the most gas on Avalanche, Gnosis, and Fantom over the past 90 days, using over $740k in gas. This was 76% more than was spent on the runner-up, Stargate, which also operates in the LayerZero ecosystem. In addition, LayerZero ranks #3 on BNB Chain and #32 on Ethereum based on gas usage over the same time period.

- Blockchains (L1) with smaller dapp ecosystems must rely on interchain communication to bootstrap application-completeness. Mature blockchains such as Ethereum have a diverse dapp ecosystem, allowing users to access different products such as DEXs, lending platforms, NFT marketplaces, and more. Relatively newer blockchains typically do not have the same dapp diversity and thus need to rely on interchain communication protocols such as LayerZero to fill the gap.

- LayerZero activity is further accelerated by users speculating on an airdrop. Rumors of a ZRO token airdrop have prompted users to interact with LayerZero contracts in hopes of securing an allocation. This effect is likely amplified by Arbitrum’s ARB token airdrop in March, which was a key driver behind major spikes in user activity both preceding and following the token launch event.

- As more chains launch and app chains become more popular, we may see blockchain interoperability protocols such as LayerZero gain traction. Dapps are incentivized to move to new chains optimized for their specific use case, as they will be able to capture a larger margin (i.e. gas fees) and provide a better UX to their users. A prominent example of this trend is the Zora Network, an NFT-focused app chain operated by NFT marketplace Zora. As a result, blockchain interoperability protocols such as LayerZero are also likely to gain popularity.

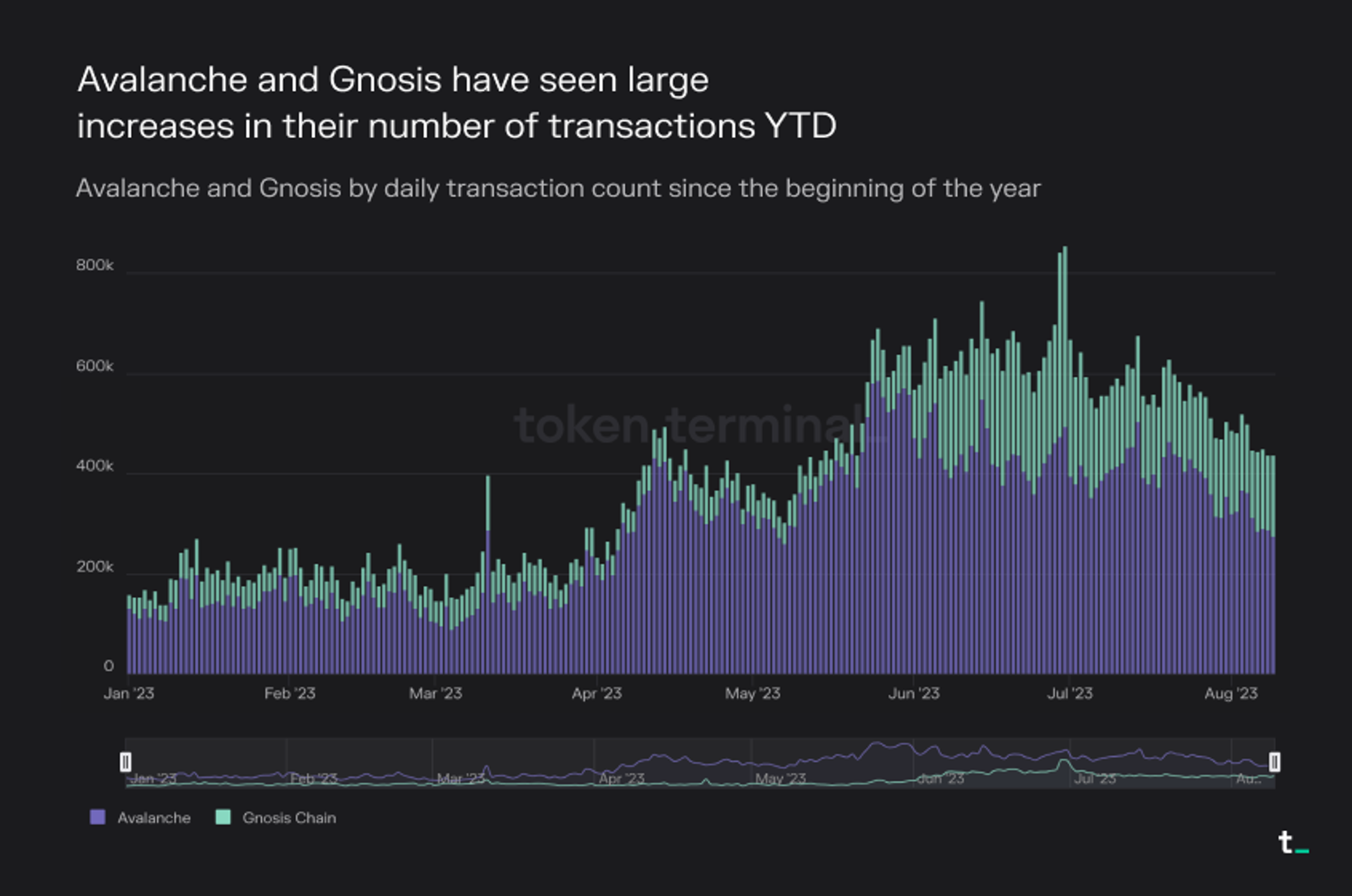

Avalanche and Gnosis have seen large increases in their number of transactions YTD

- Avalanche and Gnosis Chain have seen large increases in transaction counts YTD. The number of transactions on Avalanche grew from 4.5m in January 2023 to 12.5m in July 2023 (+178%). Similarly, monthly transactions on Gnosis increased from 1.5m to 5.2m (+247%) over this same period.

- In addition to LayerZero, Trader Joe and Zerion were also key drivers behind the transaction boom for Avalanche and Gnosis, respectively. LayerZero had the highest transaction count on both Avalanche and Gnosis in the past 180 days, with 7.60m and 4.68m total transactions, respectively. In addition, DEX Trader Joe saw 3.72m transactions on Avalanche over the past 180 days, consuming over $441k in gas fees. Wallet application Zerion saw 1.23m transactions on Gnosis over the same period.

- An attractive dapp ecosystem helps blockchains become profitable. Many blockchains introduce lucrative incentive programs in partnership with dapps in hopes of attracting long-term usage. A prominent example is Avalanche Rush, where over $180m in AVAX rewards were distributed to users of Aave and Curve on Avalanche. However, incentive programs tend to only be effective during the duration of the incentive program itself, as activity typically dissipates once users are no longer being rewarded. Sustainable blockchain usage generally requires organic development and user activity.

Other key highlights from the blockchains (L1) market sector

Avalanche

- On July 25th, the Avalanche Foundation announced Avalanche Vista, a $50m program to drive onchain asset tokenization. Avalanche Vista will target a diverse array of assets, including equity, credit, real estate, commodities, and more.

Filecoin

- Filecoin recently partnered with LongHashX to launch an accelerator program for developers building on top of the Filecoin Virtual Machine (FVM). The program will begin in October, with developers able to receive investments of up to $200k from LongHashX and Protocol Labs.

Gnosis Chain

- Gnosis Chain went through its Shapella upgrade on August 1st. Following the upgrade, stakers participating in securing the network can now withdraw their staked GNO from the consensus layer.

NEAR Protocol

- NEAR Protocol announced the Blockchain Operating System in March, which allows developers to create composable and blockchain-agnostic frontends.

Tezos

- On June 26th, Tezos deployed their Nairobi upgrade, which improves the network’s performance. This upgrade marks the fourteenth update to the network to date.

Changelog

Recent updates and improvements to the blockchains (L1) market sector on Token Terminal.

| Action | Business impact |

|---|---|

| New listing of Cronos. | New listing of Cronos. This has increased Token Terminal’s coverage of the Blockchains (L1) market sector. |

| New listing of Ronin. | New listing of Ronin. This has increased Token Terminal’s coverage of the Blockchains (L1) market sector. |

| Addition of a new metric, transaction count, for Arbitrum, Avalanche, Bitcoin, BNB Chain, Ethereum, Fantom, Gnosis Chain, OP Mainnet, Polygon, Ronin, and Starknet. | Allows Token Terminal to provide more extensive and in-depth coverage of existing blockchains. |

| Addition of a new metric, transactions per second, for Arbitrum, Avalanche, Bitcoin, BNB Chain, Ethereum, Fantom, Gnosis Chain, OP Mainnet, Polygon, Ronin, and Starknet. | Allows Token Terminal to provide more extensive and in-depth coverage of existing blockchains. |

| Addition of a new metric, block time, for Arbitrum, Avalanche, Bitcoin, BNB Chain, Ethereum, Fantom, Gnosis Chain, OP Mainnet, Polygon, Ronin, and Starknet. | Allows Token Terminal to provide more extensive and in-depth coverage of existing blockchains. |

Video of the week

This comprehensive tutorial walks you through everything you need to know to make the most out of the platform, and the six different ways to interact with onchain data on Token Terminal.

MarketVector Indexes™ and Token Terminal to Provide Exclusive Web3 Data, Product Offerings

We're excited to announce our partnership with MarketVector, as they continue to build at the frontier of digital asset indexes!

With this partnership, Token Terminal becomes the exclusive data provider to MarketVector’s new fundamentals-weighted digital asset indexes.

As the crypto market continues to expand, we’re seeing increasing interest from investors to get exposure to the digital asset market beyond just market cap-based indexes.

At Token Terminal, we’re excited about the opportunity to function as a trusted data layer for a variety of asset management products in the crypto market.

The authors of this content, or members, affiliates, or stakeholders of Token Terminal may be participating or are invested in protocols or tokens mentioned herein. The foregoing statement acts as a disclosure of potential conflicts of interest and is not a recommendation to purchase or invest in any token or participate in any protocol. Token Terminal does not recommend any particular course of action in relation to any token or protocol. The content herein is meant purely for educational and informational purposes only, and should not be relied upon as financial, investment, legal, tax or any other professional or other advice. None of the content and information herein is presented to induce or to attempt to induce any reader or other person to buy, sell or hold any token or participate in any protocol or enter into, or offer to enter into, any agreement for or with a view to buying or selling any token or participating in any protocol. Statements made herein (including statements of opinion, if any) are wholly generic and not tailored to take into account the personal needs and unique circumstances of any reader or any other person. Readers are strongly urged to exercise caution and have regard to their own personal needs and circumstances before making any decision to buy or sell any token or participate in any protocol. Observations and views expressed herein may be changed by Token Terminal at any time without notice. Token Terminal accepts no liability whatsoever for any losses or liabilities arising from the use of or reliance on any of this content.

Stay in the loop

Join our mailing list to get the latest insights!

Continue reading

Customer stories: Token Terminal’s Data Partnership with Linea

Through its partnership with Token Terminal, Linea turns transparency into a competitive advantage and continues to build trust with its growing community.

Introducing Tokenized Assets

Token Terminal is expanding its standardized onchain analytics to cover the rapidly growing category of tokenized real-world assets (RWAs) – starting with stablecoins, tokenized funds, and tokenized stocks.

Customer stories: Token Terminal’s Data Partnership with EigenCloud

Through its partnership with Token Terminal, EigenCloud turns transparency into a competitive advantage and continues to build trust with its growing community.