Newsletter

Crypto fundamentals – Charts and trends to watch

A walkthrough of the most interesting charts and trends in crypto, with a focus on key business drivers and protocol fundamentals.

This week’s newsletter focuses on the NFT marketplaces market sector, which has a designated dashboard on Token Terminal. Let’s dig in!

NFT marketplaces are platforms that allow users to buy, sell, and/or create non-fungible tokens such as digital media, collectibles, art, assets, etc.

Introduction

- NFT (non-fungible token) marketplaces are smart contract-based exchanges that allow for the permissionless trading of unique assets globally. NFTs allow new kinds of assets to be tokenized and brought onchain. NFT marketplaces were initially dominated by peer-to-peer trading, which suffer from low liquidity. Bidding pools, introduced by marketplaces like Blur, pool liquidity to solve this liquidity bootstrapping issue.

- NFT marketplaces allow creators to launch / monetize new digital works and collectors to trade their items freely. NFTs provide a new way for creators to sell authenticated versions of their work, while also allowing them to receive a share of the transacted value whenever their work is resold. Similarly, NFT collectors are able to collect and prove their immutable ownership of digital assets. In contrast, traditional digital assets are typically controlled and subject to change by centralized entities.

- Although primarily focused on digital art, newer NFT marketplaces are specializing in different types of NFTs. A prominent example includes Sound.xyz, an NFT marketplace that concentrates on music NFTs rather than digital art. As more unique assets are tokenized and bridged onchain (including real estate), we expect the launch of more specialized marketplaces that focus solely on certain categories of NFTs.

- New verticals are being built on top of NFTs marketplaces, including NFT lending and derivatives trading. Blur’s Blend product allows users to use their NFTs as collateral to take out loans. Similarly, protocols such as nftperp allow users to trade perpetual futures of NFT floor prices, opening up new avenues for speculation on NFTs. These verticals allow users to utilize and speculate on NFTs in new ways.

Overview

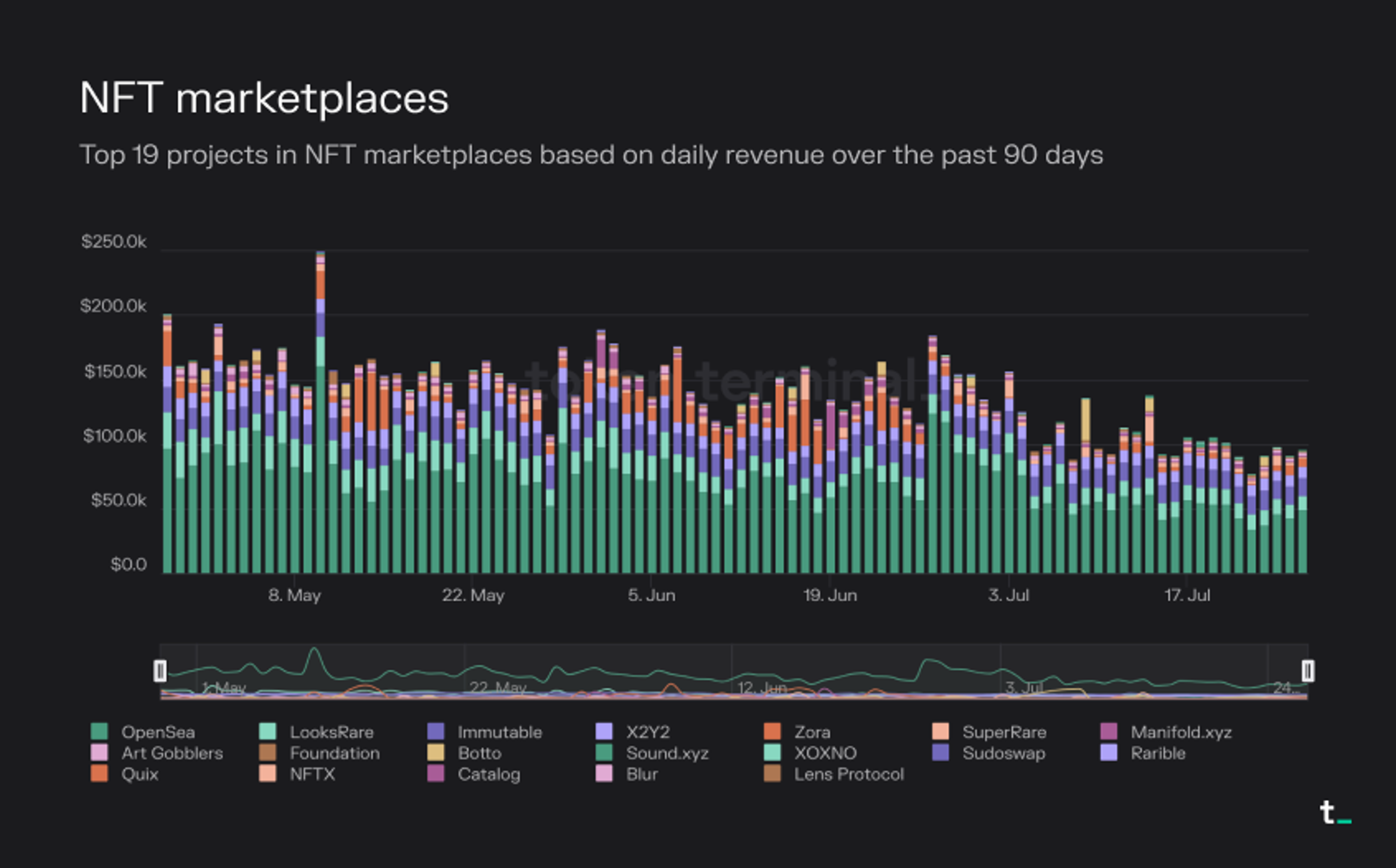

The daily revenue generated by the top projects in the NFT marketplace sector over the past 90 days is visualized below.

Scope of analysis

The NFT marketplace dashboard features 19 projects. There are numerous NFT marketplaces not yet listed on Token Terminal, so the dashboard can only give an indicative analysis of the market sector.

- Revenues across NFT marketplaces have been on a slight downtrend over the past 90 days. NFT marketplaces generated a cumulative $13.7m in revenue in the past 90 days, with a daily average of $152k. The current market leader based on revenue is OpenSea, with approximately 50% of the total revenue across the sector. It is important to note that Blur, the current leader by trading volume, does not generate revenue yet.

- NFT prices have also been falling over this period. Floor prices for most major NFT collections have experienced a decline over the past 90 days. In particular, floor prices for Azuki have fallen by over 65%, following the controversial mint of the Azuki Elementals collection on June 27th, 2023.

- NFT marketplaces are well-positioned to capture market volatility without any exposure risk. NFT marketplaces are two-sided marketplaces that facilitate transactions between NFT buyers and NFT sellers/creators. As a result, they have minimal to no exposure to volatile NFT prices and generally benefit from high market volatility.

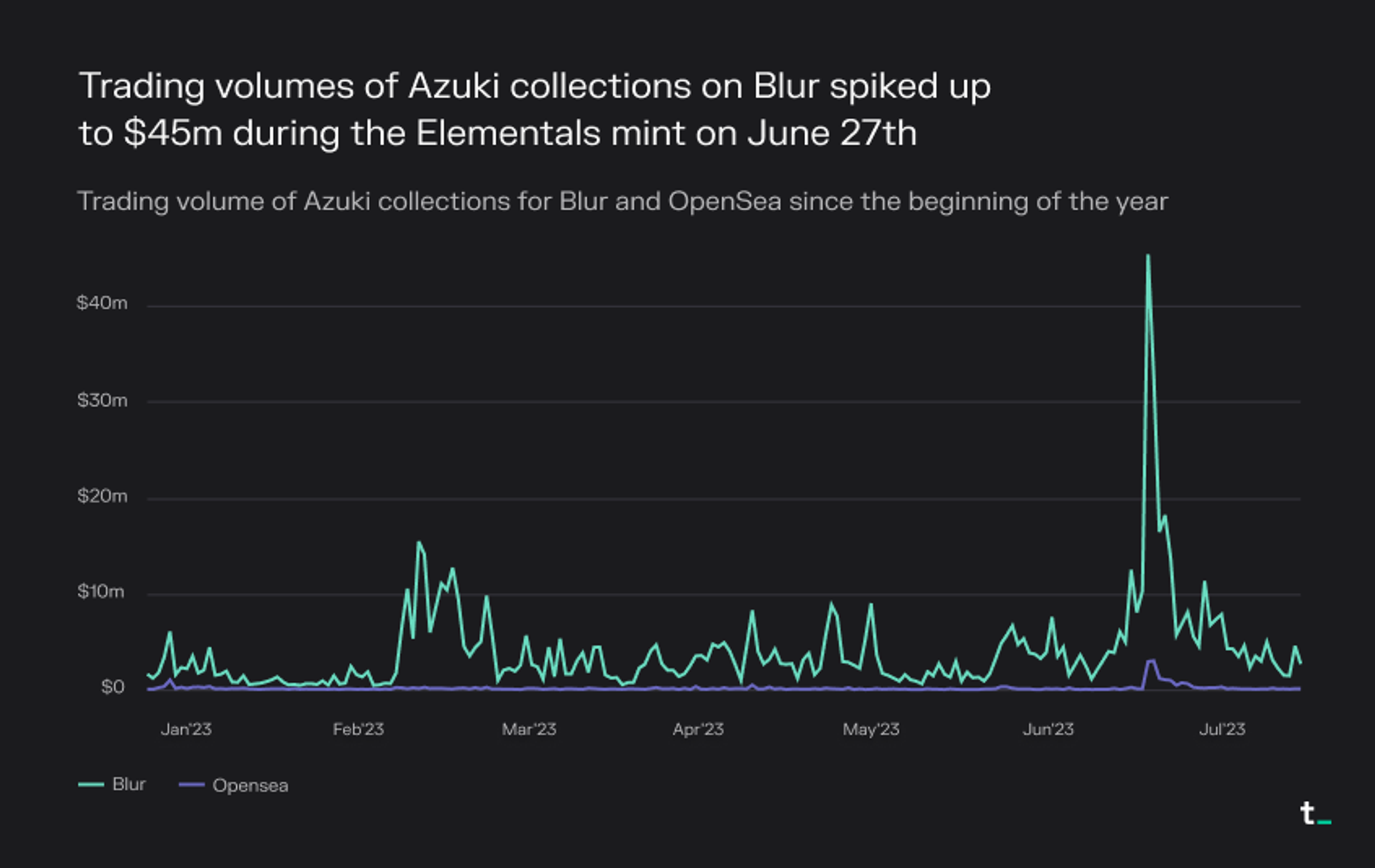

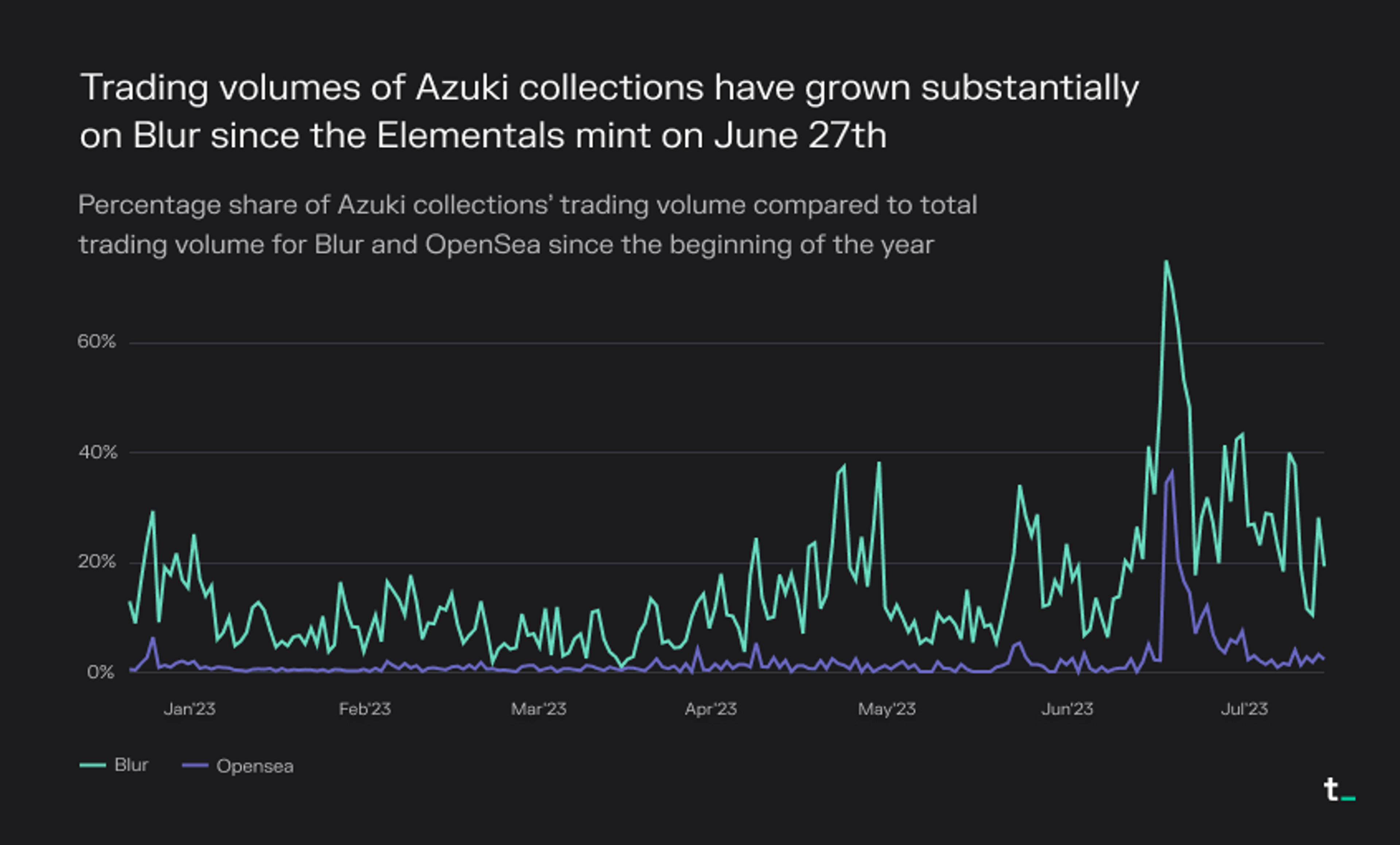

Comparison of Azuki collections' trading volume on Blur and OpenSea

- Trading volumes of the Azuki collections have grown substantially on Blur since the Elementals mint on June 27th. Following the controversial mint, cumulative trading volumes of the Azuki collections on Blur reached $236m, compared to OpenSea’s $13m. Over this period, the Azuki collections represented 39% and 10% of the total trading volume for Blur and OpenSea, respectively.

- Blur targets pro NFT traders, while OpenSea has a more general focus. Blur offers features such as the visualization of market depth, real-time listings/bidding, and a sweep function that allows users to buy NFTs in bulk. These features provide a better UX for price speculation, allowing Blur to capture most of the Azuki collections' trading volume over this period. On the other hand, OpenSea has an interface more geared toward collectors and first-time NFT buyers.

- Customer segmentation of marketplaces is important for investors to note. In addition to Blur focusing on pro traders, marketplaces such as SuperRare target art collectors, while Immutable is focused on in-game assets. As NFT marketplaces place emphasis on certain customer segments, investors can use these specializations to place directional bets on different NFT sub-categories.

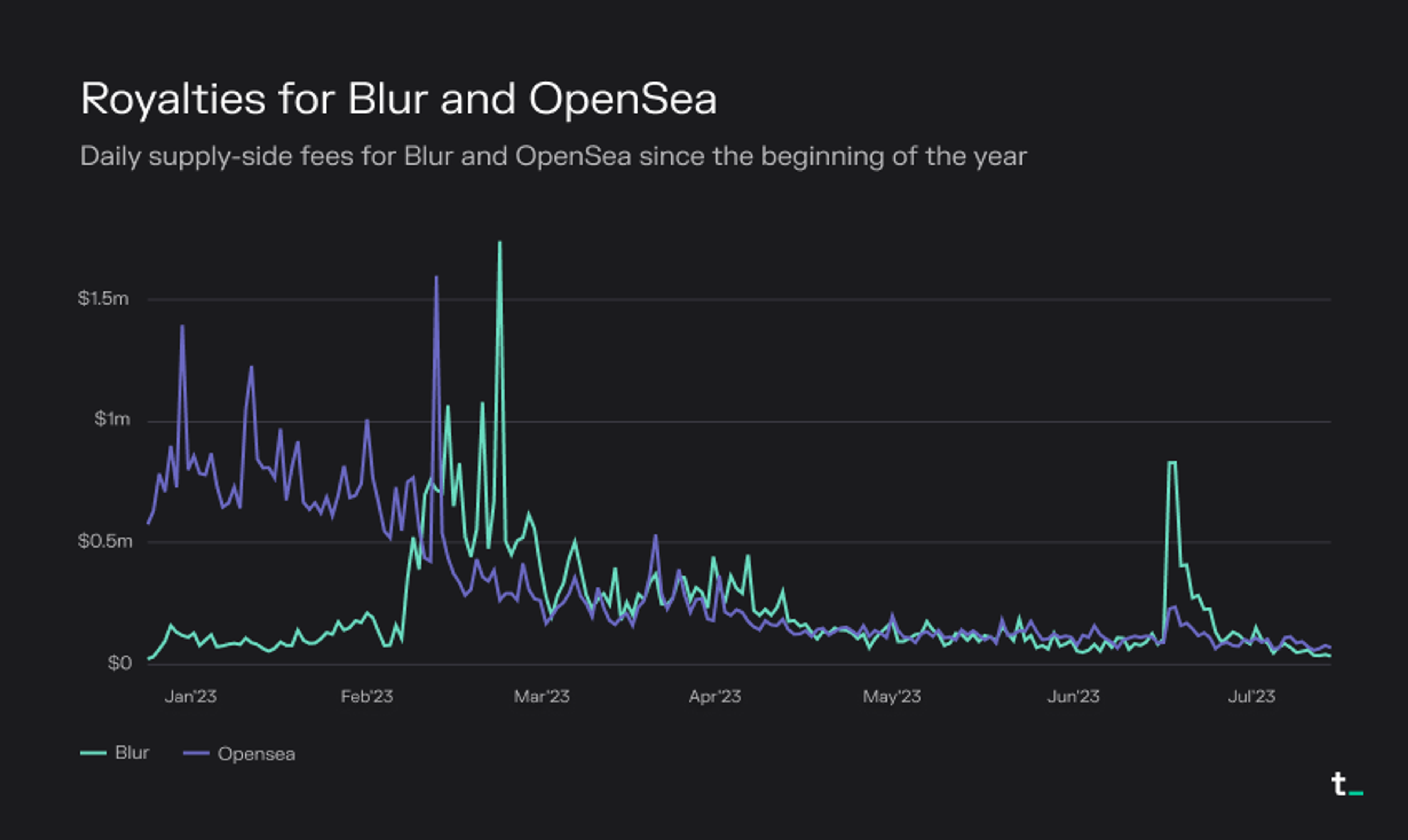

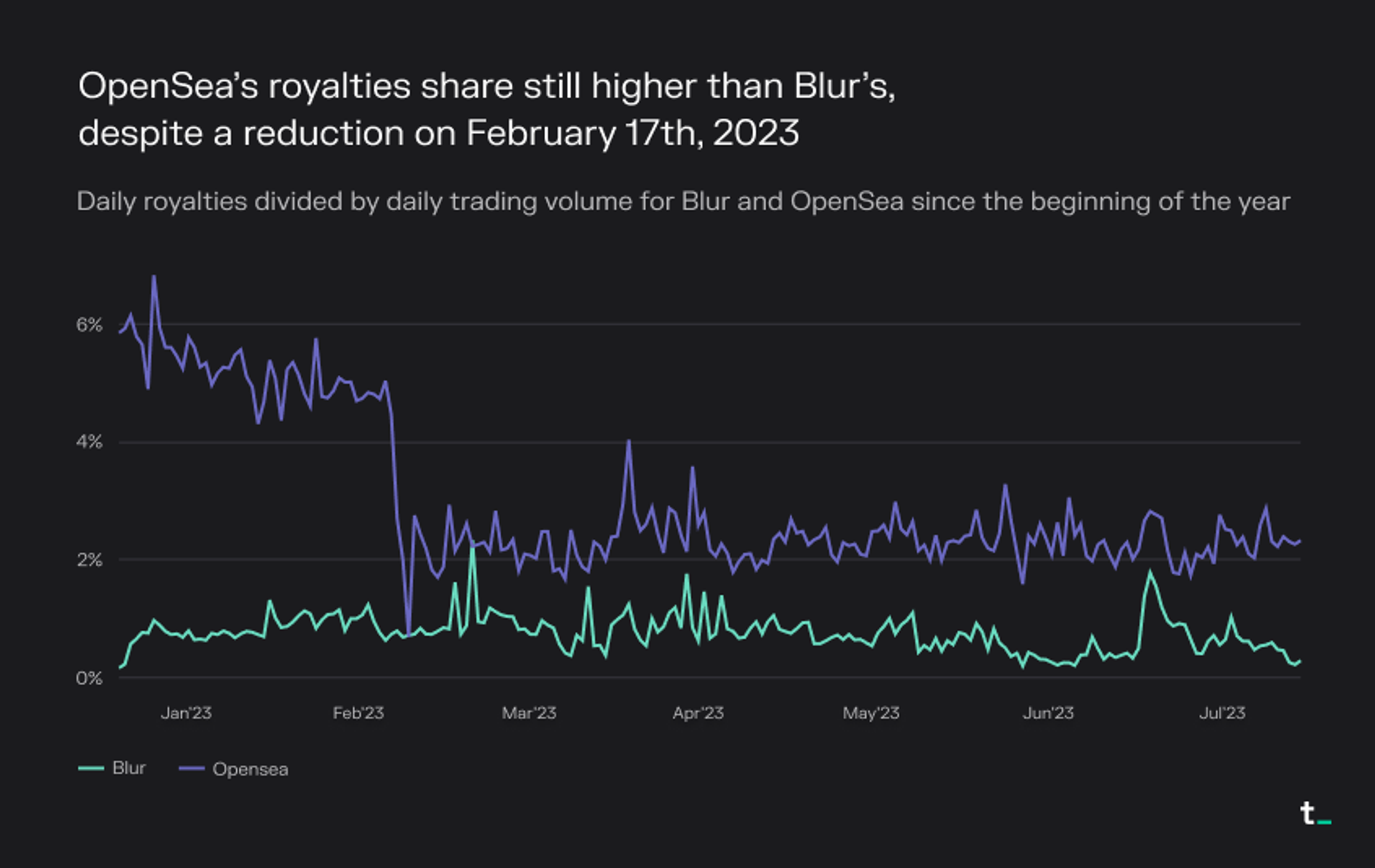

Comparison of royalties for Blur and OpenSea

- NFT royalties to creators have been trending down since early 2023. OpenSea has generated $65.5m in royalties, compared to Blur’s $44.9m year-to-date (YTD).

- Royalties are often not enforced on the NFT smart contract level and are easy to circumvent. As a result, it is up to marketplaces to honor the royalties. To attract users, many marketplaces are reducing fees by no longer applying the royalties set by NFT creators. Currently, with some exceptions, on both Blur and OpenSea, sellers can set a custom royalty amount with a minimum of 0.5%.

- Royalty cuts reduce creator earnings in the short term, but they drive innovation on creator monetization. An example includes Blur’s incentivized royalties where BLUR tokens are allocated based on the royalties set. In addition, OpenSea also introduced Drops, which make it easier for creators to earn fees from primary sales of NFTs.

- On February 17th, 2023, OpenSea’s royalties to trading volume ratio dropped by over 50%. For the period starting from the year's beginning until February 17th, the average ratio stood at 5.2%. Following February 17th, there was a marked decrease, with the average falling to 2.3%. For Blur, the royalty share has remained stable with the YTD average at 0.75%, close to the minimum enforced rate of 0.5%.

- The drop was caused by OpenSea ceasing to enforce full creator royalties. This was to compete with Blur, which operates with a similar post-change fee and royalty policy. Sellers could now change the preset royalties, which decreased them significantly. The higher royalty ratio on OpenSea can be explained by different customer segments, as discussed previously. In general, OpenSea’s target audience of collectors is more willing to support collections and their creators by setting higher royalty rates.

- As marketplaces continue to compete for users, we might see further fee and royalty reductions. In addition to OpenSea, other NFT marketplaces have also previously removed mandatory royalties, including X2Y2 in August 2022 and LooksRare in October 2022. One recent example of this is the Blur price matching where royalties can be omitted due to price matching across marketplaces. Also, NFTs traded on Blend do not have royalties enabled.

Immutable

- Immutable generated $1.5m in revenue from trading fees over the past 90 days, of which 90% were paid in the IMX token. Revenue has remained relatively stable at roughly $16.5k per day. Immutable facilitates third-party marketplaces for onchain games and apps built on Immutable X. This is in contrast to other NFT marketplaces, which tend to see more volume in ETH or in their native gas token.

- IMX is the native token on Immutable used for staking, governance, and as a currency. Immutable operates on its own L2 rollup (Immutable X), which covers all L1 publishing costs. As a result, users do not have to pay gas fees when transacting on Immutable. This removes friction to use IMX, as users do not need to hold both ETH and IMX.

- Immutable is planning to introduce even more utility features for IMX, including gas payments. Although IMX already has many use cases, it will also be the native gas token for Immutable’s zkEVM blockchain. This means we are likely to see the usage of IMX increase within the ecosystem.

Other key highlights from the NFT marketplace market sector

Blur

- Blur recently launched their new v2 contracts, which enable more effective gas-optimization and trait bidding. The team has also added several quality-of-life features, such as ENS support, NFT transfers, collection social links, and custom listing durations.

Immutable

- Immutable is able to aggregate marketplaces operating on Immutable X (gaming-focused L2 rollup) through its Global Orderbook product. Today, Global Orderbook connects over 14 marketplaces, including Gamestop, Rarible, and TokenTrove. Half of all trades on Immutable are filled on non-origin marketplaces, meaning that games and marketplaces building on the Immutable platform experience doubled liquidity as a result. Global Orderbook also enables enforceable royalties, ensuring that creators get royalty payments.

- Although the Immutable team has built their own NFT marketplace, they have since shifted the focus to supporting third-party marketplaces that are part of their ecosystem. As of May 2023, over 150 games have committed to build on the Immutable ecosystem, with 25 games already live.

LooksRare

- LooksRare recently launched Season 2 of their Gems rewards program. Gems are earned by traders and frequent visitors of LooksRare and can be converted to LOOKS tokens at the end of the season.

- On July 18th, LooksRare v2 also integrated with OpenSea Pro, OpenSea’s NFT aggregator product.

OpenSea

- On July 21, OpenSea released Deals, enabling users to offer up multiple NFTs and WETH in return for another user’s NFTs. This allows for a more customizable purchasing experience, as NFT buyers were previously limited to swapping WETH or other fungible tokens for their desired NFTs.

X2Y2

- X2Y2 recently launched ERC-20 loans, allowing altcoin (such as SHIB or PEPE) holders to convert their tokens into NFTs. These NFTs can then be utilized as collateral to borrow USDC. X2Y2 also introduced UX improvements to their NFT borrowing product, including NFT Protection (loan extensions) and Batch Borrow (multiple borrows in one transaction).

Zora

- On June 21st, Zora launched the Zora Network, a blockchain (L2) built on top of Ethereum using the OP stack. The team attributed the main reason behind the launch to significantly lower gas costs compared to Ethereum mainnet, with NFT minting costing less than $0.50 in gas. Token Terminal’s integration of Zora Network data is currently in progress.

Changelog

Recent updates and improvements to the NFT marketplace market sector on Token Terminal.

| Action | Business impact |

|---|---|

| New listing of Immutable. | New listing of Immutable. This listing tracks IMX-related metrics and NFT trading facilitated by Immutable on StarkEx. This has increased Token Terminal’s coverage of the NFT marketplace sector. |

| Update Blur to account for v2 exchange metrics. | Allows Token Terminal to provide more accurate and up-to-date data for Blur. |

| Update Sound.xyz with the most recent deployments on Ethereum and Optimism. | Allows Token Terminal to provide more accurate and up-to-date data for Sound.xyz. |

| Update Zora with ERC-1155 mints on Ethereum and add Optimism metrics. Metrics on Zora Network are not yet tracked. | Allows Token Terminal to provide more accurate and up-to-date data for Zora. |

| Update Manifold.xyz with the most recent deployments on Ethereum and Optimism. Supply-side fees and revenue are not yet tracked on Optimism. | Allows Token Terminal to provide more accurate and up-to-date data for Manifold.xyz. |

| Bug fix for Rarible revenue. New denylist contracts were added to exclude internal transactions. | Allows Token Terminal to provide more accurate and up-to-date data for Rarible. |

Video of the week

In this episode of the Fundamentals podcast, we’re joined by H.E. Justin Sun, the Founder of Tron – a blockchain (L1).

Listen to the episode

We discuss Tron’s position within the blockchain market and the core optimizations they have focused on. We also uncover the drivers behind Tron’s market-leading user activity numbers, speak about the network’s impressive traction in emerging markets, what perspective blockchains should be analyzed and valued from, and plans for the future.

Tron’s dashboard on Token Terminal: https://tokenterminal.com/terminal/projects/tron

Timestamps:

00:00 Introduction

01:01 Tron’s core value proposition

01:49 The main optimizations that Tron has focused on

04:12 User activity on Tron (current state & drivers)

07:33 Expanding outside of emerging markets

10:31 What applications are best suited to be built on Tron?

13:00 Valuing blockchains as settlement layers

15:56 What’s next for Tron?

Product tip of the week

Tips for getting the most out of Token Terminal

We’ve introduced three new metrics: maximum supply, transactions per second, and transaction count.

- Maximum supply shows the maximum amount of tokens that will ever exist. When compared with a token's circulating supply, we can get an understanding of how many tokens have yet to enter the market.

- Transactions per second show the daily average of actual transactions per second of a blockchain. It is important to note that this is different from their hypothetical maximum throughput.

- Transaction count shows the number of onchain transactions on a blockchain since its launch.

The authors of this content, or members, affiliates, or stakeholders of Token Terminal may be participating or are invested in protocols or tokens mentioned herein. The foregoing statement acts as a disclosure of potential conflicts of interest and is not a recommendation to purchase or invest in any token or participate in any protocol. Token Terminal does not recommend any particular course of action in relation to any token or protocol. The content herein is meant purely for educational and informational purposes only, and should not be relied upon as financial, investment, legal, tax or any other professional or other advice. None of the content and information herein is presented to induce or to attempt to induce any reader or other person to buy, sell or hold any token or participate in any protocol or enter into, or offer to enter into, any agreement for or with a view to buying or selling any token or participating in any protocol. Statements made herein (including statements of opinion, if any) are wholly generic and not tailored to take into account the personal needs and unique circumstances of any reader or any other person. Readers are strongly urged to exercise caution and have regard to their own personal needs and circumstances before making any decision to buy or sell any token or participate in any protocol. Observations and views expressed herein may be changed by Token Terminal at any time without notice. Token Terminal accepts no liability whatsoever for any losses or liabilities arising from the use of or reliance on any of this content.

Stay in the loop

Join our mailing list to get the latest insights!

Continue reading

Customer stories: Token Terminal’s Data Partnership with Linea

Through its partnership with Token Terminal, Linea turns transparency into a competitive advantage and continues to build trust with its growing community.

Introducing Tokenized Assets

Token Terminal is expanding its standardized onchain analytics to cover the rapidly growing category of tokenized real-world assets (RWAs) – starting with stablecoins, tokenized funds, and tokenized stocks.

Customer stories: Token Terminal’s Data Partnership with EigenCloud

Through its partnership with Token Terminal, EigenCloud turns transparency into a competitive advantage and continues to build trust with its growing community.