Interview

In this blog series we interview founders in the crypto space to learn more about what’s going on with their projects.

Token Terminal

•

In this blog series we interview founders in the crypto space to learn more about what’s going on with their projects.

We sat down with Stani Kulechov, CEO of Aave. Aave is a protocol for earning interest on your deposits and borrowing assets. Recently, Aave surpassed $70M in market size.

Background

Aave is a decentralized money market protocol where users can earn interest on deposits and borrow assets. Aave is open-source, so our code is freely available and anyone can build on it.

We currently support 17 different crypto assets, 6 of which are stablecoins.

Who is the team behind Aave?

The Aave team is 17 people with headquarters is in Shoreditch, London. We also have an office in Switzerland and some are spread out around Europe working remotely.

We’re currently looking to expand into the Asian markets, and we’re looking for Korean and Vietnamese community managers.

Aave started off as ETHLend with P2P lending. Why did you decide to pivot to a pool-based model?

With the P2P model for lending, borrowers and lenders were able to create customized loan requests and loan offers with parameters for interest rate, duration, collateral, etc. In the case of ETHLend, our system would match the loan offers and requests if they were compatible.

With Aave lending pools, the liquidity deposited in the protocol gets distributed to borrowers automatically, and borrowers can borrow instantly by putting up collateral. This also gives borrowers more options in terms of the time period of the loan — they can pay it back any time as long as their collateral remains above the correct threshold.

Lending pools make it easier for users to participate from both sides of the market — lending and borrowing.

We have read that Aave will allow anyone to launch lending pools with their own parameters and governance. Can you elaborate on that?

Yes, launching your own pools is part of our multi-pool strategy. In the beginning, Aave will launch a few pools to kickstart the multi-pool ecosystem.

Our first pool will be a lending pool with Uniswap liquidity provider tokens (Unitokens) as a collateral. This means that Uniswap liquidity providers are able to leverage their liquidity by using their Unitokens as collateral in Aave.

In essence, Aave will create new money markets. The idea of each money market is to support unlocking value from DeFi and bringing yields to depositors that are in line with their risk appetite. For example, Aave would be able to create pools with different risk levels, each attracting different kinds of liquidity.

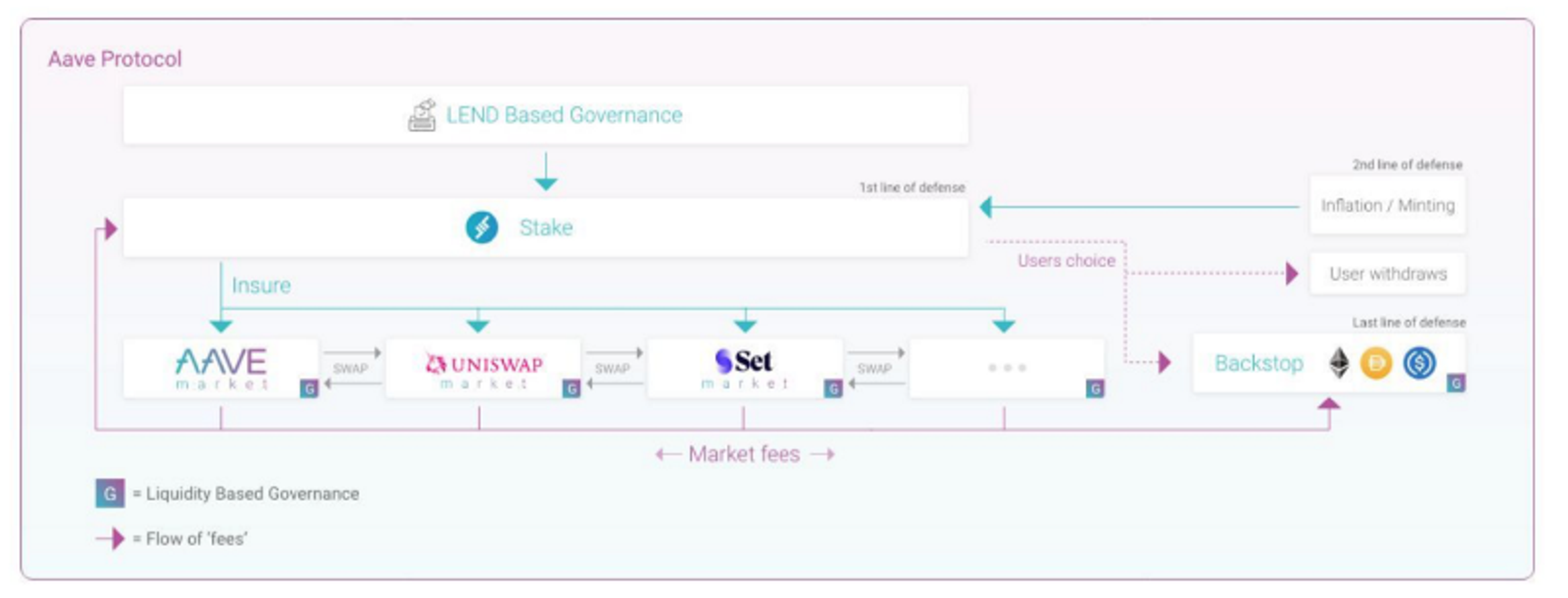

LEND will be used to govern the global risk parameters and voting on which pools can be subject to LEND-based insurance. Liquidity providers are able to use their aTokens to vote and govern the specific pool that they have deposited funds in. This is a big change compared to current governance systems since the users will have a say in how their liquidity is treated.

Can you tell us more about the LEND token?

The LEND token will be the governance token for Aave Protocol. Once the governance is released (coming soon!), LEND tokenholders will be able to vote on protocol updates and govern the Aave Protocol ecosystem.

We are exploring using LEND tokens as an opt-in insurance for new pools that the governance can vote upon. Eventually anyone can create their own lending pools with their own assets and parameters, and if the pool is risk savvy, it can be plugged into our token-based insurance system.

The insurance system is based on learnings from recent events in DeFi. LEND holders secure the protocol by staking LEND into a pool against incentives (fee sharing and issuance of LEND). In case of an insurance occurrence, this LEND is slashed when the governance votes upon it. Second, if the staked LEND does not cover the deficit, LEND will be minted based on governance vote.

Third, the protocol has a built-in backstop module where Aave community members can deposit stablecoins against incentives. When the slashed or minted LEND is auctioned, the backstop module acts as a buyer to secure the market price of that LEND, and once bought, the LEND is locked for a fixed period of time. That way any auctioned LEND would not flood into the market and the protocol would have additional stability as it’s secured by the LEND value.

What are some other key features that separate Aave from other lending protocols?

One key feature is the “Aave Interest-bearing tokens” aka “aTokens”. When you deposit in Aave Protocol, you receive a corresponding amount of “aTokens” which are pegged 1:1 to the underlying asset. aTokens accrue interest directly in your wallet, so you can watch your balance grow every second. You can also redirect this interest to any Ethereum address of your choice.

Another cool feature is the rate switching when borrowing. This lets you choose between a stable and variable interest rate at any time so you always get the optimal interest rate. For example, if you originally choose the variable interest rate but then this rate shoots up, you can switch to the stable rate. We also tweaked the interest rate models to fill the gap between the variable and stable rate models, making the new stable rate much more competitive.

The main feature everyone’s been buzzing about are the Flash Loans, which lets devs borrow without needing any capital to put up as collateral. Basically, they give any dev the same opportunities as the wealthiest people, all in a low risk scenario, since transactions are simply reversed if the loan isn’t paid back. These have been used for good and for “evil”, but we don’t think they are bad. Flash Loans can be used as building blocks for all sorts of tools in DeFi, not just for making money with arbitrage.

What have flash loans been used for so far?

Flash loans have mostly been used for arbitrage. Another use case has been self-liquidations, which use Flash Loans to pay back money they owe to avoid liquidation penalties.

My favorite example of this is DeFi Saver, which is probably doing the most with Flash Loans on a daily basis. DeFi Saver lets you manage all your DeFi activity from one place. It also lets you set an automatic self-liquidation bot to avoid liquidation penalties by doing a Flash Loan to pay back your debt, free your collateral, and sell part of your collateral to reimburse Aave Protocol in one transaction.

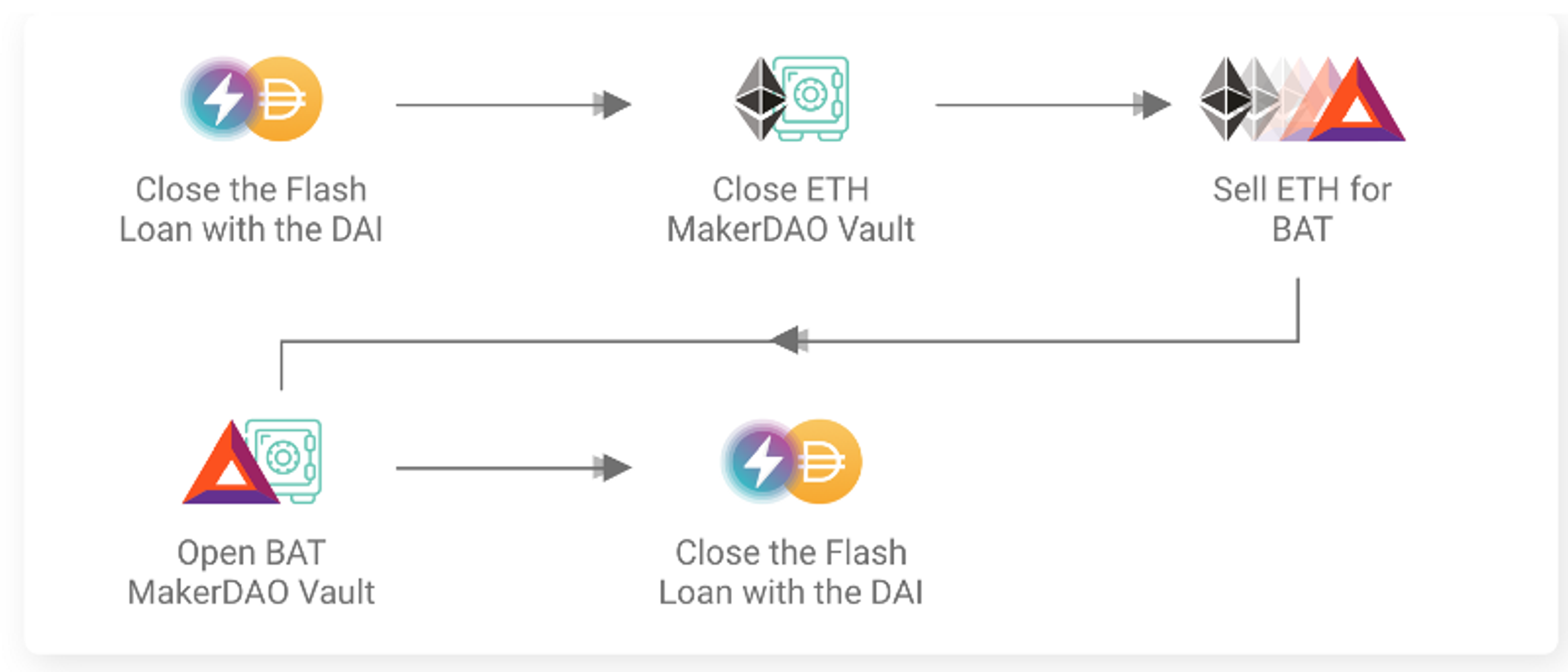

Collateral swaps are also very cool — the first one was actually made by a dev David Truong who has since joined Aave.

Flash Loan use case: Collateral swap of a MakerDAO Vault

What are some less known use cases for Aave that you are excited about?

The most interesting thing in this regard is that Aave is being used as a core building block in DeFi. Every week, new products are launched that showcase the composability of DeFi and utilize Aave.

For example, we have recently seen interest rate forwarding and fixed deposit rates provided by Blazar and 88mph, which both utilize Aave for liquidity. Both protocols allow you to access future interest upfront.

What lessons have you learned from building Aave that you would like to share with others building on DeFi?

Part of building Aave that I think we did really well, was watching what other major players in the DeFi space were doing. Lots of people are coming up with great ideas, so we took inspiration from these and incorporated some into Aave Protocol — while improving on them as well.

DeFi composability broadens the ecosystem, and one of my favorite parts of building Aave has been to see what devs build on top of these tools. I would also highlight the importance of audits and security measures — Aave takes these very seriously, and we have always aired on the side of caution when implementing new features, like Flash Loans.

We also want to bring DeFi to more mainstream users, so making our interface very user-friendly is important, and we spend a lot of time thinking about the flow, testing, and changing the UX/UI based on feedback we get from our community.

Aave has grown very quickly to ~$70M in market size. What have been the key adoption drivers?

Definitely integrations — we’ve integrated with My Ether Wallet, DeFi Saver, Idle Finance, Zerion, Trustwallet, and many more. This helps drive the adoption of Aave Protocol. Quality integrations puts the protocol in the hands of more users, which attracts more deposits.

We also have a large community and receive feedback on our product quickly. There is also a solid team at Aave working hard on bringing a good user experience to DeFi and building product features that serve our user base.

Can you talk about the product roadmap for the next 12 months? What are the biggest milestones for 2020?

In the near future, we will see a multi-pool approach of Aave. This means that there will be pools with different lending parameters and risk profiles. We believe that the holy grail of DeFi is the ability to package risk and offer it to depositors. That allows more liquidity as there would be different offerings for various risk appetites. Pools can be packaged for low risk institutional market participants, all the way to yield hackers who are looking to earn more. The very first pool will be with Uniswap liquidity provider tokens as collateral.

Aave Protocol is moving towards total decentralization, where governance will be in the hands of the users. For now, we are governing the protocol ourselves in case any issues should arise, but the governance update will be implemented quite soon.

You can find more information about Aave on their website https://aave.com and on their Twitter, Medium, and Discord.

The authors of this content, or members, affiliates, or stakeholders of Token Terminal may be participating or are invested in protocols or tokens mentioned herein. The foregoing statement acts as a disclosure of potential conflicts of interest and is not a recommendation to purchase or invest in any token or participate in any protocol. Token Terminal does not recommend any particular course of action in relation to any token or protocol. The content herein is meant purely for educational and informational purposes only, and should not be relied upon as financial, investment, legal, tax or any other professional or other advice. None of the content and information herein is presented to induce or to attempt to induce any reader or other person to buy, sell or hold any token or participate in any protocol or enter into, or offer to enter into, any agreement for or with a view to buying or selling any token or participating in any protocol. Statements made herein (including statements of opinion, if any) are wholly generic and not tailored to take into account the personal needs and unique circumstances of any reader or any other person. Readers are strongly urged to exercise caution and have regard to their own personal needs and circumstances before making any decision to buy or sell any token or participate in any protocol. Observations and views expressed herein may be changed by Token Terminal at any time without notice. Token Terminal accepts no liability whatsoever for any losses or liabilities arising from the use of or reliance on any of this content.

Stay in the loop

Join our mailing list to get the latest insights!

Continue reading

Customer stories: Token Terminal’s Data Partnership with Linea

Through its partnership with Token Terminal, Linea turns transparency into a competitive advantage and continues to build trust with its growing community.

Introducing Tokenized Assets

Token Terminal is expanding its standardized onchain analytics to cover the rapidly growing category of tokenized real-world assets (RWAs) – starting with stablecoins, tokenized funds, and tokenized stocks.

Customer stories: Token Terminal’s Data Partnership with EigenCloud

Through its partnership with Token Terminal, EigenCloud turns transparency into a competitive advantage and continues to build trust with its growing community.