Research

A note about Uniswap trading volume discrepancy

Summary

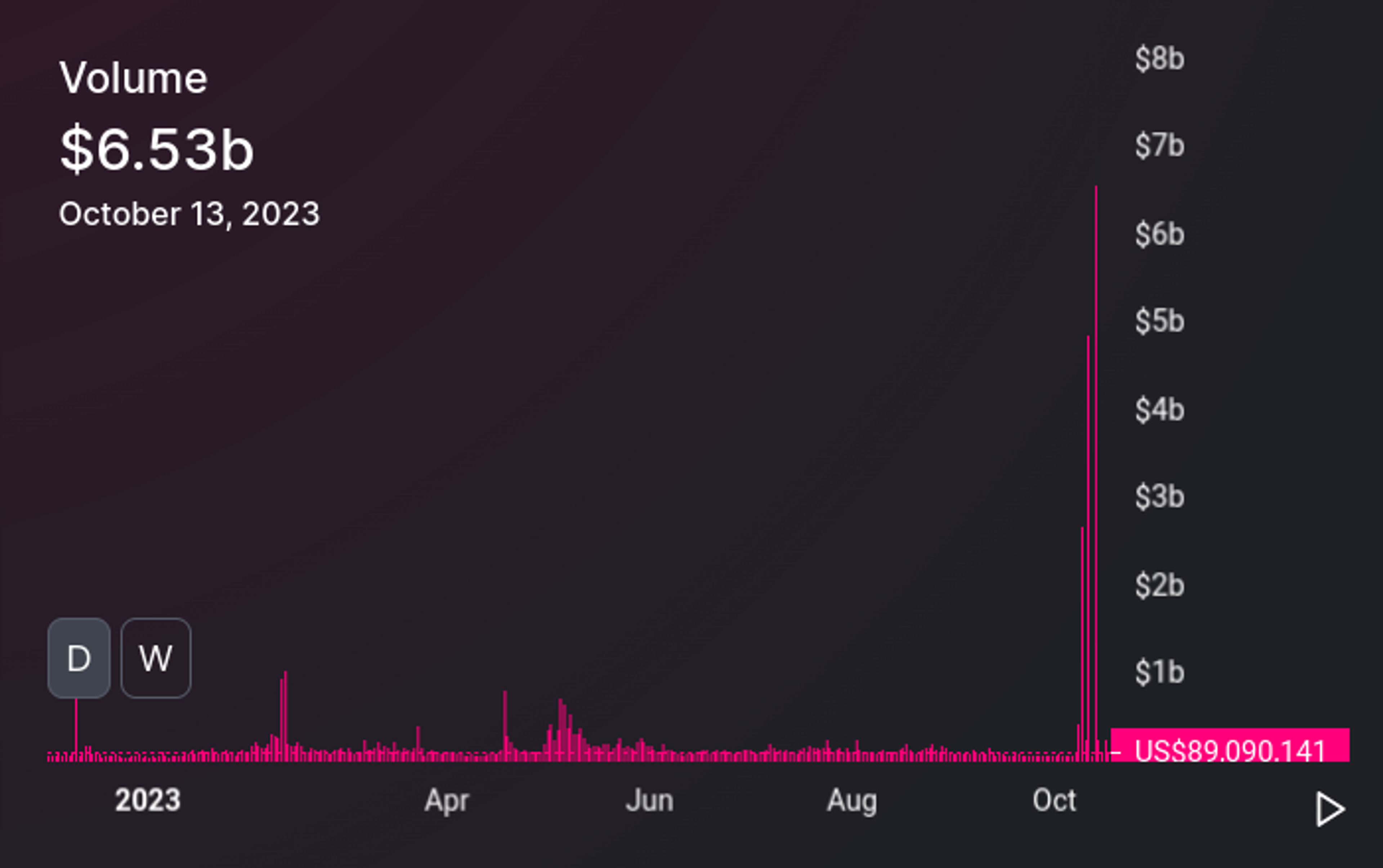

Two weeks ago (between October 11-13th), a handful of data providers and media outlets reported that Uniswap had experienced a recent surge in trading volume:

Some of our customers forwarded us articles and screenshots, and inquired about the recent spike, noting that they hadn’t observed it on Token Terminal's Uniswap dashboard. The figure below shows Uniswap’s 7-day moving average trading volume as reported by Token Terminal:

We investigated the issue internally and identified the cause of the discrepancy between the reported metrics. We discovered trades involving a suspicious token and large flash loans. As we don't consider this to represent valid business activity, our methodology has been designed to exclude such activity from the reported trading volume. Data providers relying on 3rd-party API's are subject to including trading volume manipulation in their dashboards.

It was not possible for anyone to swap this specific token at an inflated price at any point.

The following section of this article explains the details.

Reason for the spike in trading volume

As an example, Messari reports DefiLlama to be the source of the data in their report. DefiLlama, in turn, used the official Uniswap subgraph to fetch the trading volume data. A glance at the Uniswap analytics pages reveals that the spike in trading volume comes from Uniswap v2, which, according to the subgraph, had a trading volume of a whopping $6.53b on October 13th. It’s worth noting that this is roughly 100 times more than expected based on trading activity over the previous month.

However, $6.37b or 98% of the total trading volume on October 13th was from the RYU-WETH pair:

The RYU token is a suspicious token created on October 10th, and there have been some very unusual trades in the pair. For example, let’s look at the following transaction:

In this transaction, a user known as “c0ffeebabe.eth” (famous from previous incidents) took a flash loan of 52k WETH from Balancer, swapped it for 1.9m RYU, swapped the 1.9m RYU back to 0.0035 more WETH than what was originally borrowed from Balancer, and repaid the flash loan. The gas costs were 0.0022 ETH, meaning that the trader made a profit due to the RYU token’s autoBurnLiquidityPairTokens function that burned 10% of the pair’s RYU after the first swap, causing an asymmetry in price. This enabled the trader to swap the RYU back for more WETH than what was used in the initial trade. We have identified dozens of similar transactions (see Appendix), effectively draining the pair’s WETH reserves:

We also observed similar activity in pairs SBI-WETH and UPITGO-WETH.

How do these transactions explain the discrepancy in the reported trading volume values? In this case, the subgraph calculates the trading volume as the amount of WETH swapped multiplied by its price (i.e., the trading volume of the swap mentioned above is roughly 52k WETH * 1.5k USD / WETH = 78m USD). If neither one of the swapped tokens is in the pre-defined whitelist of trusted tokens, the trade is not taken into account in trading volume calculations. However, we at Token Terminal have noticed that such an approach can miss important trades and be unreliable.

Instead, we calculate the trading volume by calculating the value of the tokens going both ways in USD and choosing the lesser value. Again, using the previously mentioned trade as an example, the value of the tokens going both ways is (we use rounded values in this example but the code uses precise values)

- RYU: 1.9m RYU * 0.00009 USD / RYU ≈ 171 USD (the value used in our calculations)

- WETH: 52k WETH * 1.5k USD / WETH ≈ 78m USD

This explains the discrepancy in the reported trading volume values. DefiLlama has since fixed the values they reported by blacklisting RYU, and their values are now in agreement with those we have always reported. In this case, our methodology is more robust than blacklisting suspicious tokens/pairs since maintaining the list requires identifying suspicious tokens, which often occurs after issues with the resulting metrics arise. However, in some other cases, we also use blacklists until we develop more robust methods.

The Token Terminal price feed

At Token Terminal, we calculate the price of a digital asset in USD by considering all the DEX pools in which the asset is traded and determine the average price using the liquidity-weighted average price (LWAP). We use LWAP because the spot price of a DEX pool more closely aligns with the market price when liquidity is higher, a phenomenon attributable to arbitrage bots. The higher the liquidity, the more profitable it becomes to balance the pool with the market, and the arbitrageuer must pay for gas.

Daily prices used in our transformations are calculated by averaging over time. It is important to note that while the transactions with flash loans caused a temporary increase in the spot price of RYU in the RYU-WETH pair, the duration of this increase was zero (i.e., it all happened within one transaction in a single block). It was not possible for anyone to swap RYU for WETH at an inflated price at any point:

The highest spot price of RYU in the pair was never above 261 gwei (≈0.0004 USD) at the end of block.

The role of protocol fees

Uniswap does not charge any protocol fees, which means that all the swap fees (0.3% in Uniswap v2) go to liquidity providers. On the other hand, SushiSwap, for example, charges a protocol fee of 0.05% on every trade which goes to the protocol treasury. This means that in the transaction shown above, $41k worth of WETH would have gone to the protocol treasury, rendering such flash-loan-assisted trades completely unprofitable.

The perils of permissionless finance

Due to the nature of Ethereum and other similar blockchains being Turing complete, analyzing decentralized finance requires subject matter expertise and continuous research. Bad actors can manipulate the metrics. For example, in this instance, someone could take a leveraged long position on UNI and manipulate the trading volume metrics, expecting it to drive up the price of UNI. This could be done with just a few hundred or thousand USD, and it could be much more profitable with sufficient capital and leverage. At Token Terminal, we do our best to protect our customers from such manipulation.

The value of our vertically integrated data pipeline

At Token Terminal, we operate our node infrastructure for 12 (and counting) blockchains, granting us access to all the essential raw data required to calculate the metrics for the projects we track. Instead of relying on 3rd-party data and metrics, our in-house research team develops the logic for calculating the metrics reported on our platform from raw data. This puts us in control of our data instead of relying on black-box APIs, community subgraphs, or code written by external developers. We do our best to provide up-to-date and accurate data, excluding suspicious transactions not representative of business activity. If there are issues with our data, our data stack allows us to identify and fix the issues. Since the value proposition of Token Terminal relies on correct data, this is a must-have for us.

Appendix: list of relevant transaction hashes

Want to verify these transactions yourself? Here is a list of hashes of transactions with swaps of 1k WETH or more in the RYU-WETH pool:

0xdd84779885d02e94280458487444c32223a52cf11045d84588ac90eb86125a7e

0xfc4dbc81f25b3b6a0cf9c5aae4a0a8090a939ac0b4c33b3ea70c0cb611af65a6

0x83790f6a062063951c1df60790551a694ad929d5e193a87173b9b81a8a57bf1f

0x7c232ec73bbdb63a2a4aaafc951681df63e015fdc07aa01b8cf2bd68cd937cdf

0x04fd53f4f61eca5c22e040df4c358cd3dc36f4e19e3186ad40403493c3da65d9

0x09b4a76417fdd6301148577d561ca610534231944f09751ddf10076e420cf11c

0x2a8aacd7738b0b6005e44acea062e93d05c40ae8d2a748f7cda34ff4cbe987b1

0x3c3c80764653442c053d088a484cf9bdf4d71bf77c02fe8f36c2f5ae0b5cbb63

0xa5ec2c504b3f4208395d38d90d9454322a4b4769bccea8ea644850c329340abb

0x724316f4f869a50cac627c892e90ef6c6c176a47d1e82759f0c77ff8d83f1741

0x98c6d43a36c22f832df9c535b6caadf27b9b87c96e33435f915fedafb0c0e0c2

0x4d2c7d8e4f7f54c088442a9f071c69524d649dccb8b48eec1eabfe97cdf4a972

0x10355d16f60187c28e80e5b05d25062ba9f7b944e02c7c37896ff79806a7935a

0xb27c8fbe9338e0524abe488a78c157ccb78853bac21b4c7022c62f279eef5fcd

0x095b6f09eb72b0cbd57fd99f77bcbcd5cf8bab1bd5de1762449d266eb6bca775

0x87d065ba03723b97c293ca96582d08b7c72e7cffbdfca5a10830ac2e4bae4c8c

0xa78fa35bfd104b8bdd9f10638ac144b1db26f503c85211692c71bf8fb236ca44

0xf68754abdee27aec5fd9932531b026719abc05fed54e6520f72084bc34654b2b

0x19efc443fa3fbff5453809ab0f78739f8935525a13ca9b03a5555be15e8cb8d8

0x0e15986f9bc3630d5f998dd8602271d52c9560cdfdb55e256f1a4b5ddb5cb328

0x812d88a346115fbf10103ca45388173ed3ecbecb01268e456047caab623f680d

0xa455357b8ab932afacbc4f7f976d9fd3240af900e0381667462828b12d29134a

0x1f0022e4fa8e54fe73ff35cfeaec238b70084ba8118cbe55aa060dc56a2e91bc

0x00e387202ddf0c00e86de1074e9aeff54951e784c2623e6dd72d896044eca45e

0xc174dc5e05effda9d8a6ab5ebdeb732adeaf3ba7d2a6da6bc459f09049f96127

0x6c0d679a515ee09c9315c6a3294a32bd0d32d38100a911a387b1952aeb5a2550

0xe2ec7edeba3d69e3449aec70513b6ede944555cbc0a1d6d749f471c77f450cd6

0x53fb4760db535e5f1b2a64b588c365b094bc88c8be488fe832484a66f934350d

0x251c2535936ec442b4653e533df32dd6e0b560104c966b0e9b07b0607df13b28

0xd1faa6e8d669b401fbbe66800f8596ef3bfaf824aaf13cc43148a2017d977106

0xe43dd69b59895ec50ffd815875490d6879be2f66bde97f22a740a7baa126f9dd

0xf513aa9e2f1e019c2ecd19efeb56ef2e1aa21662682d774536ae1252d8e7d403

0xda937e32217014908c5fb64844e8c07b7b29e7895b842408e0edc2a40a6c565f

0x415dd0977b722aad92871c6b6ac62d5f652daee57ac7fed2882bbbad92a7e185

0x156bdc0d836fe158c6a1193fff3593d96afd88e4c1ceada76a0e3b35368c8c9c

0xec72830aeddb6ec4fc99c3f4e9641c7f1455734d32841df3d2a027343892257f

0x85142d10d353291cf304facf4c6429c1253e73d814e9e69771c863399a04ff60

0x4ecf5651f8fd662db7672711e4851b18f6358d1dc65d41b9d8856f3c1a948f24

0x24a8a62d4fbd2c1b8365b11c7b0f6611b2bd3c2a2f12036cbb6f2e1fcf18f2ee

0x3a3fbc14f9e293d53ff6284ffa2aae261773d3786aaed98807d3d39506c5cb28

0x29545c49e3a567ef5140bae283f0845a1b7d8b99f417e8bdea4701e5cd17d564

0x34ba0b082bab868d1a234e8326a1c84a7f33c03c6071a7463f1c24ad555359a1

0x668968a76963b0210debc1a9f40b80aa6c4e01c9b49fa27d9a573237ca84a8d7

0x8657828cde09907a089c83e3340d5ae4b966896be0b712fe921ee1a90cc31b7b

0x94ff14afa7426505acfd64bdd828df2d763b2e9416ba8d7a85c096a04085b564

0xac11be535cc7d7996b9b57ebf5b2f11213336b50e90701963d872c45f837fc86

0x6e98777a0a9bdfe2d0ec2b1602dbafd862a790fcae0af61185dd15f4a2408e42

0x821428e58129fa4ac188f1d30a70944d5a857e1992e59a0819f7f724a632378c

0xa5495fac6169ced2a267fc57692aeaef5a7364fd9ef759817f17bee5a44f3ef4

0x3681ce61f5a7eedeee64abfe5bdee21e794f589d975aac6fc39707561b852ca5

0x3f1e494e9d5864f7cc9f02e4b17f9c9517549fd8de20e24a33d16dffe11668d6

0x515f9debd4c3ff06bd96a47c23cbe166afb874e0d144d28c123b402fda42c17f

0x3d269e57bf9cc51c3ed2a85b946ebcd1048280564baa5c27a77e2ced34480572

0x13d341bd204a55960df983c66b426994525b352f8f2f206d2df168713f1ab2e1

0xe7edb0f03434c9459917bf4fb01911bf3590e2ae62dcb79c77283839865413d1

0x37431530ecddb997d62e4c293106436853604e5c2dd233bf7ce46f1d6bf11cfa

0xafc97b8a9f764a60441ce570199e175a4b1c677badaf66fb98b536aa6a0ade69

0xdce5d3e1e28b5acc5398396580aa1caf3d01e2bedd8690184aa2f691f400c2c5

0x488ae930da7cca2414ab0d16bd379c13f123110f5645ff2c39c6b1d011cecb71

0x45efadaadf0cfceb15191ff3ef8c497da5612784436accc71ab90c68baf41938

0x4271eae0f8915594eae100b1565fb4e8aebbb2132cb2522709150c30029d44a4

0xdfde8f90f6ead04171f3ab8f489322051adad3bd4f17fb33d51413c05358b961

0x841e9b43a766d15b83e31378ef625edc344a4f46d14d2c52c70d84d717e85725

0x3949b072d3c799bba3f8bad1c7beb26d7b3a348b7e9bc3f8ea641954cab52449

0x42a5a79c70f8e3aebd678143f5998a8cf0efa21e061ee9c3456b4c00eed00659

0x1de631611d61c2532187438f23074022ba4c06bd611f11bac33e51f31b23a3af

0x858708c09c211ecff6b8dc7d9980669bf4ea4e21caeba8f98cf569ecd4e3e6d2

0x0e8b1437ac2bfb30b7c18bd827078cd7dc2f4887d7614744fb686fac783b10e5

0x963153c32b5700e14f06964138a65f71b55ec28f3ad1fe36080ae26ac6c89cc5

0x127429f9dea8ef0fc4b150b3c34bf5632f20ca76305530a609ed8ca037dbc396

0xb0b41e968cccc0039600b7568cdbdc0cc088335635d695ca22b025ee49e3f548

0xddd6d2970cd2046c0b0af79a4dd7b76ae3444f4ff346fc0a7f6690d80bcfa176

0x57eb41dbe94371c949505ceb76fb5bf9dd46bdadffc7c0d6862c6438afdf7e00

0x8ed609d81756a73b9f18802237802cfc3a4ef4ec7375e470058a3995d6b51fe8

0xde865184a5b4a5e1930513ce309a562b2a7ddd3dea35fc8464ffe535d08c9793

0xf42d03ceadbfe5108ff29cbd1b6b834c96fcf2f7130674a726d492664ecb8ae2

0x6030185a0190de0d58b6a75627a633ba420742652d68262eb950bd7424066997

0xa5d264c4709ba279268192389e2b3738db83b3311c29c77453875e360f8bda51

0x15e6010b0bc2270baefa773af018576b2b47729ddd86bd577ab3a62d17c499b0

0xad94f661468b6ef55a357287e5b2452858778dfaeb4a33696807d13e38698497

0x546a9fe395977176a509c8466f45616133bad3c0dd9a4b5d26750a8d691619ba

0xdd84779885d02e94280458487444c32223a52cf11045d84588ac90eb86125a7e

0xfc4dbc81f25b3b6a0cf9c5aae4a0a8090a939ac0b4c33b3ea70c0cb611af65a6

0x83790f6a062063951c1df60790551a694ad929d5e193a87173b9b81a8a57bf1f

0x7c232ec73bbdb63a2a4aaafc951681df63e015fdc07aa01b8cf2bd68cd937cdf

0x04fd53f4f61eca5c22e040df4c358cd3dc36f4e19e3186ad40403493c3da65d9

0x09b4a76417fdd6301148577d561ca610534231944f09751ddf10076e420cf11c

0x2a8aacd7738b0b6005e44acea062e93d05c40ae8d2a748f7cda34ff4cbe987b1

0x3c3c80764653442c053d088a484cf9bdf4d71bf77c02fe8f36c2f5ae0b5cbb63

0xa5ec2c504b3f4208395d38d90d9454322a4b4769bccea8ea644850c329340abb

0x724316f4f869a50cac627c892e90ef6c6c176a47d1e82759f0c77ff8d83f1741

0x98c6d43a36c22f832df9c535b6caadf27b9b87c96e33435f915fedafb0c0e0c2

0x4d2c7d8e4f7f54c088442a9f071c69524d649dccb8b48eec1eabfe97cdf4a972

0x10355d16f60187c28e80e5b05d25062ba9f7b944e02c7c37896ff79806a7935a

0xb27c8fbe9338e0524abe488a78c157ccb78853bac21b4c7022c62f279eef5fcd

0x095b6f09eb72b0cbd57fd99f77bcbcd5cf8bab1bd5de1762449d266eb6bca775

0x87d065ba03723b97c293ca96582d08b7c72e7cffbdfca5a10830ac2e4bae4c8c

0xa78fa35bfd104b8bdd9f10638ac144b1db26f503c85211692c71bf8fb236ca44

0xf68754abdee27aec5fd9932531b026719abc05fed54e6520f72084bc34654b2b

0x19efc443fa3fbff5453809ab0f78739f8935525a13ca9b03a5555be15e8cb8d8

0x0e15986f9bc3630d5f998dd8602271d52c9560cdfdb55e256f1a4b5ddb5cb328

0x812d88a346115fbf10103ca45388173ed3ecbecb01268e456047caab623f680d

0xa455357b8ab932afacbc4f7f976d9fd3240af900e0381667462828b12d29134a

0x1f0022e4fa8e54fe73ff35cfeaec238b70084ba8118cbe55aa060dc56a2e91bc

0x00e387202ddf0c00e86de1074e9aeff54951e784c2623e6dd72d896044eca45e

0xc174dc5e05effda9d8a6ab5ebdeb732adeaf3ba7d2a6da6bc459f09049f96127

0x6c0d679a515ee09c9315c6a3294a32bd0d32d38100a911a387b1952aeb5a2550

0xe2ec7edeba3d69e3449aec70513b6ede944555cbc0a1d6d749f471c77f450cd6

0x53fb4760db535e5f1b2a64b588c365b094bc88c8be488fe832484a66f934350d

0x251c2535936ec442b4653e533df32dd6e0b560104c966b0e9b07b0607df13b28

0xd1faa6e8d669b401fbbe66800f8596ef3bfaf824aaf13cc43148a2017d977106

0xe43dd69b59895ec50ffd815875490d6879be2f66bde97f22a740a7baa126f9dd

0xf513aa9e2f1e019c2ecd19efeb56ef2e1aa21662682d774536ae1252d8e7d403

0xda937e32217014908c5fb64844e8c07b7b29e7895b842408e0edc2a40a6c565f

0x415dd0977b722aad92871c6b6ac62d5f652daee57ac7fed2882bbbad92a7e185

0x156bdc0d836fe158c6a1193fff3593d96afd88e4c1ceada76a0e3b35368c8c9c

0xec72830aeddb6ec4fc99c3f4e9641c7f1455734d32841df3d2a027343892257f

0x85142d10d353291cf304facf4c6429c1253e73d814e9e69771c863399a04ff60

0x4ecf5651f8fd662db7672711e4851b18f6358d1dc65d41b9d8856f3c1a948f24

0x24a8a62d4fbd2c1b8365b11c7b0f6611b2bd3c2a2f12036cbb6f2e1fcf18f2ee

0x3a3fbc14f9e293d53ff6284ffa2aae261773d3786aaed98807d3d39506c5cb28

0x29545c49e3a567ef5140bae283f0845a1b7d8b99f417e8bdea4701e5cd17d564

0x34ba0b082bab868d1a234e8326a1c84a7f33c03c6071a7463f1c24ad555359a1

0x668968a76963b0210debc1a9f40b80aa6c4e01c9b49fa27d9a573237ca84a8d7

0x8657828cde09907a089c83e3340d5ae4b966896be0b712fe921ee1a90cc31b7b

0x94ff14afa7426505acfd64bdd828df2d763b2e9416ba8d7a85c096a04085b564

0xac11be535cc7d7996b9b57ebf5b2f11213336b50e90701963d872c45f837fc86

0x6e98777a0a9bdfe2d0ec2b1602dbafd862a790fcae0af61185dd15f4a2408e42

0x821428e58129fa4ac188f1d30a70944d5a857e1992e59a0819f7f724a632378c

0xa5495fac6169ced2a267fc57692aeaef5a7364fd9ef759817f17bee5a44f3ef4

0x3681ce61f5a7eedeee64abfe5bdee21e794f589d975aac6fc39707561b852ca5

0x3f1e494e9d5864f7cc9f02e4b17f9c9517549fd8de20e24a33d16dffe11668d6

0x515f9debd4c3ff06bd96a47c23cbe166afb874e0d144d28c123b402fda42c17f

0x3d269e57bf9cc51c3ed2a85b946ebcd1048280564baa5c27a77e2ced34480572

0x13d341bd204a55960df983c66b426994525b352f8f2f206d2df168713f1ab2e1

0xe7edb0f03434c9459917bf4fb01911bf3590e2ae62dcb79c77283839865413d1

0x37431530ecddb997d62e4c293106436853604e5c2dd233bf7ce46f1d6bf11cfa

0xafc97b8a9f764a60441ce570199e175a4b1c677badaf66fb98b536aa6a0ade69

0xdce5d3e1e28b5acc5398396580aa1caf3d01e2bedd8690184aa2f691f400c2c5

0x488ae930da7cca2414ab0d16bd379c13f123110f5645ff2c39c6b1d011cecb71

0x45efadaadf0cfceb15191ff3ef8c497da5612784436accc71ab90c68baf41938

0x4271eae0f8915594eae100b1565fb4e8aebbb2132cb2522709150c30029d44a4

0xdfde8f90f6ead04171f3ab8f489322051adad3bd4f17fb33d51413c05358b961

0x841e9b43a766d15b83e31378ef625edc344a4f46d14d2c52c70d84d717e85725

0x3949b072d3c799bba3f8bad1c7beb26d7b3a348b7e9bc3f8ea641954cab52449

0x42a5a79c70f8e3aebd678143f5998a8cf0efa21e061ee9c3456b4c00eed00659

0x1de631611d61c2532187438f23074022ba4c06bd611f11bac33e51f31b23a3af

0x858708c09c211ecff6b8dc7d9980669bf4ea4e21caeba8f98cf569ecd4e3e6d2

0x0e8b1437ac2bfb30b7c18bd827078cd7dc2f4887d7614744fb686fac783b10e5

0x963153c32b5700e14f06964138a65f71b55ec28f3ad1fe36080ae26ac6c89cc5

0x127429f9dea8ef0fc4b150b3c34bf5632f20ca76305530a609ed8ca037dbc396

0xb0b41e968cccc0039600b7568cdbdc0cc088335635d695ca22b025ee49e3f548

0xddd6d2970cd2046c0b0af79a4dd7b76ae3444f4ff346fc0a7f6690d80bcfa176

0x57eb41dbe94371c949505ceb76fb5bf9dd46bdadffc7c0d6862c6438afdf7e00

0x8ed609d81756a73b9f18802237802cfc3a4ef4ec7375e470058a3995d6b51fe8

0xde865184a5b4a5e1930513ce309a562b2a7ddd3dea35fc8464ffe535d08c9793

0xf42d03ceadbfe5108ff29cbd1b6b834c96fcf2f7130674a726d492664ecb8ae2

0x6030185a0190de0d58b6a75627a633ba420742652d68262eb950bd7424066997

0xa5d264c4709ba279268192389e2b3738db83b3311c29c77453875e360f8bda51

0x15e6010b0bc2270baefa773af018576b2b47729ddd86bd577ab3a62d17c499b0

0xad94f661468b6ef55a357287e5b2452858778dfaeb4a33696807d13e38698497

0x546a9fe395977176a509c8466f45616133bad3c0dd9a4b5d26750a8d691619ba

The authors of this content, or members, affiliates, or stakeholders of Token Terminal may be participating or are invested in protocols or tokens mentioned herein. The foregoing statement acts as a disclosure of potential conflicts of interest and is not a recommendation to purchase or invest in any token or participate in any protocol. Token Terminal does not recommend any particular course of action in relation to any token or protocol. The content herein is meant purely for educational and informational purposes only, and should not be relied upon as financial, investment, legal, tax or any other professional or other advice. None of the content and information herein is presented to induce or to attempt to induce any reader or other person to buy, sell or hold any token or participate in any protocol or enter into, or offer to enter into, any agreement for or with a view to buying or selling any token or participating in any protocol. Statements made herein (including statements of opinion, if any) are wholly generic and not tailored to take into account the personal needs and unique circumstances of any reader or any other person. Readers are strongly urged to exercise caution and have regard to their own personal needs and circumstances before making any decision to buy or sell any token or participate in any protocol. Observations and views expressed herein may be changed by Token Terminal at any time without notice. Token Terminal accepts no liability whatsoever for any losses or liabilities arising from the use of or reliance on any of this content.

Stay in the loop

Join our mailing list to get the latest insights!

Continue reading

Customer stories: Token Terminal’s Data Partnership with Linea

Through its partnership with Token Terminal, Linea turns transparency into a competitive advantage and continues to build trust with its growing community.

Introducing Tokenized Assets

Token Terminal is expanding its standardized onchain analytics to cover the rapidly growing category of tokenized real-world assets (RWAs) – starting with stablecoins, tokenized funds, and tokenized stocks.

Customer stories: Token Terminal’s Data Partnership with EigenCloud

Through its partnership with Token Terminal, EigenCloud turns transparency into a competitive advantage and continues to build trust with its growing community.