This research piece has been written by Michael Nadeau from The DeFi Report, in collaboration with Token Terminal.

Background & progress to date

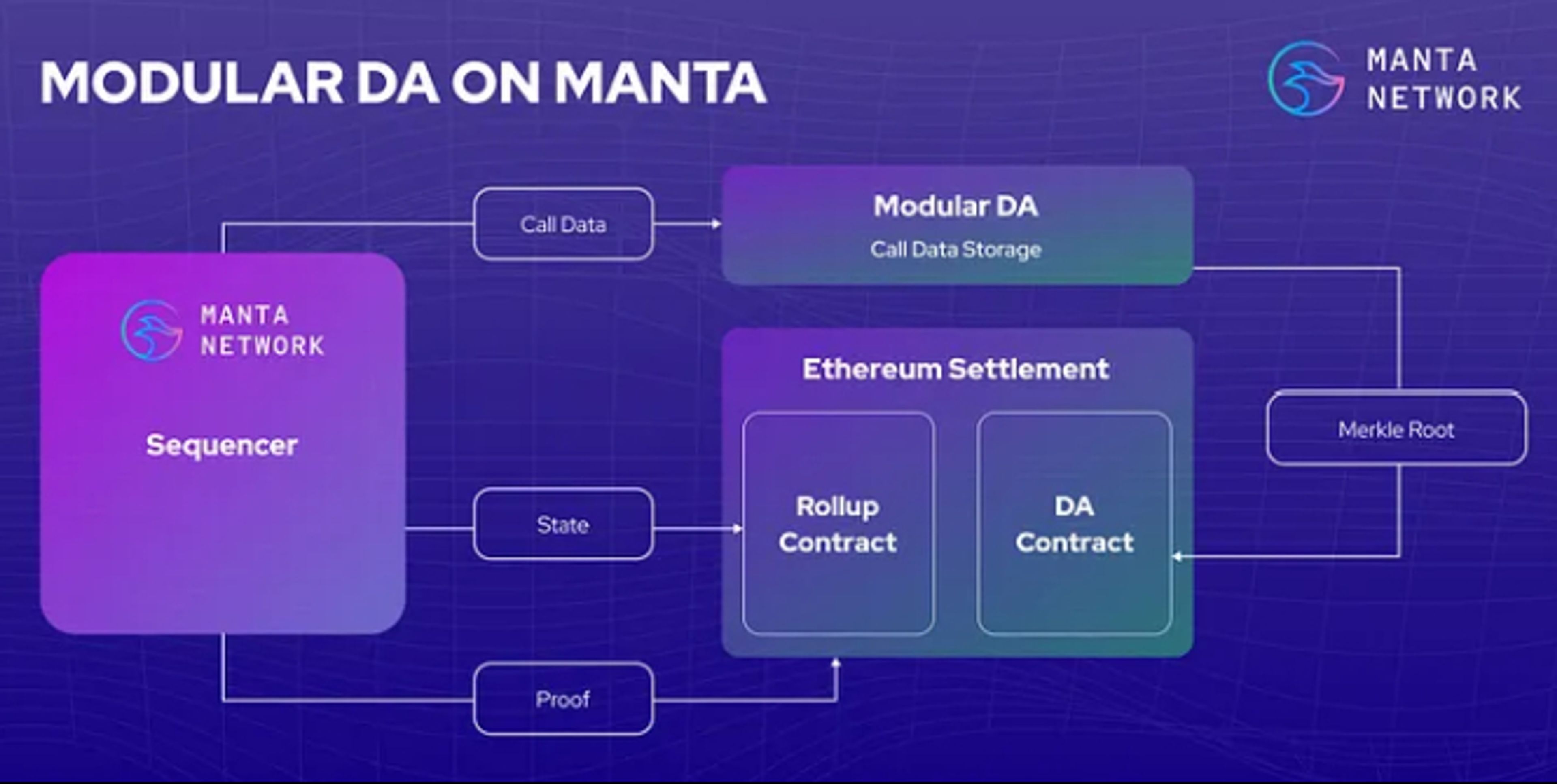

Manta Pacific is an Ethereum-based L2 rollup deployed on the OP stack, leveraging Celestia for data availability, and Ethereum for settlement. Having launched its mainnet just 3 months ago, the team is already planning its next steps — and a new home within the Polygon zkEVM environment.

Please note that Manta Network consists of Manta Pacific and Manta Atlantic. Manta Atlantic is a zero-knowledge L1 on Polkadot building zero-knowledge onchain identities and credentials. This report covers Manta Pacific only — the zero-knowledge Ethereum-based rollup.

Manta Pacific’s mission is to build modular, scalable zk infrastructure for web3 applications by taking advantage of all of the key technologies available within the stack — to provide the best user experience to app developers. Instructive to this approach is the willingness to pivot to Polygon zkEVM and adopt Celestia as a data availability solution — lowering gas fees 6x in the process, with expectations for costs to drop an additional 20x in the near term.

With a global network of 60+ developers currently building out the platform, Manta has recently showcased some interesting go-to-market and liquidity bootstrapping strategies.

New Paradigm

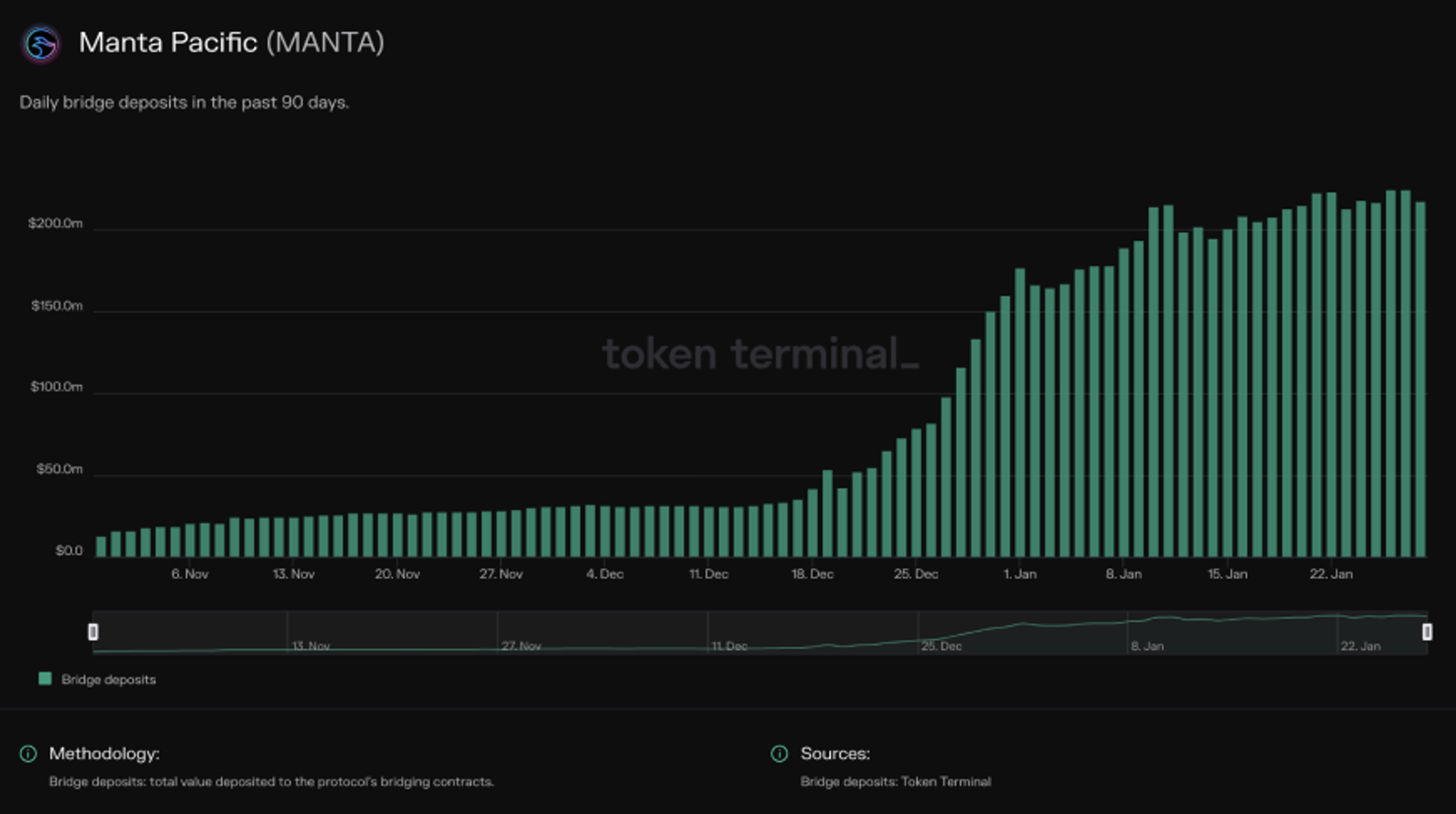

As the name would imply, the project is currently entering a New Paradigm — evidenced by a massive influx of value-locked onchain. And we mean massive. The network had $32m of value bridged over two months ago. Today? It’s up 27x to $850m.

So what is this New Paradigm and how did this happen?

The short answer is that Manta has created some really interesting crypto-economic incentives for users to bridge assets. And then they sprinkled on some fun (and slightly combative) marketing tactics for good measure.

Let’s address crypto economics first — because Manta solved a real problem here. Anyone who has bridged assets to an L2 knows that you have to lock up your ETH to do so. Your ETH stays on the L1, and then you get a receipt token which can be used in the new L2 environment. This means the ETH is sitting there as idle, unproductive capital.

Manta is the first live protocol to change this. Instead of users incurring opportunity costs when bridging, Manta stakes the ETH (or USDC), and returns the yield to the bridged user. Meanwhile, users can leverage their receipt token (STONE) to earn additional yield within Manta’s emerging DeFi ecosystem. The initial lock-up period is 69 days.

But wait, there’s more.

Users participating in New Paradigm will also got first dibs on the first Manta token airdrop and have the optionality to earn even further yield via Eigen layer re-staking.

The takeaway?

By offering native yield + additional financial incentives to bridge assets over, Manta essentially created an opportunity cost for users with assets on alternative L2s.

Money talks.

Let’s be very clear. Crypto natives may be bullish on the tech — but they are also here to make money. The Manta team understands this — and that’s why their assets onchain grew 31x when they rolled out New Paradigm. It’s up to Manta (and the developers building on the platform) to keep these new users now.

As far as the marketing? Manta isn’t exactly “playing nice” and that’s ok as far as we’re concerned. Nobody ever said competing in an open-source start-up environment was easy.

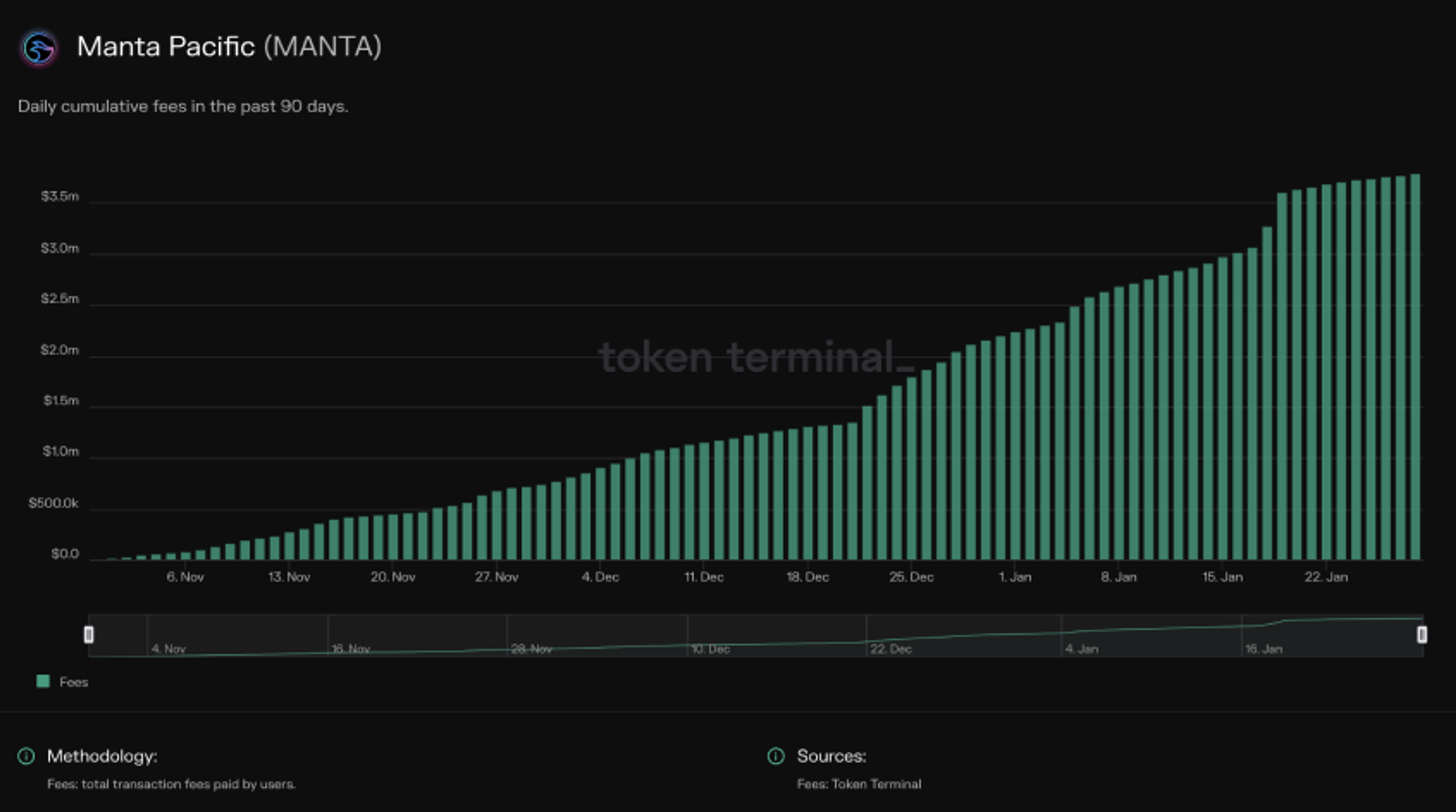

Aside from the astronomical rise in TVL, the network has done $3.7 million in fee revenue over the last 90 days.

And here we can visualize assets currently bridged over — with New Paradigm incentives acting as the catalyst.

The total value of bridged assets can be categorized into canonically bridged value (CBV) and externally bridged value (EBV). From the below chart, we can see that CBV is $216m, representing value bridged from L1 Ethereum to Manta Pacific via canonical bridges, which lock tokens on the L1 and mint IOU tokens on the L2.

Do note that the chart does not yet include EBV, which currently sits at $631m and involves assets from external blockchains, bridged to Manta Pacific through non-canonical bridges that lock tokens on their native ledgers and mint IOU tokens on the L2.

To take it a step further, below are the top bridges in terms of gas fees over the last 90 days:

So far, Orbiter Bridge is seeing the most user activity. The $43k in gas fees came from a total of 430k transactions, just over 10 cents per transaction on average.

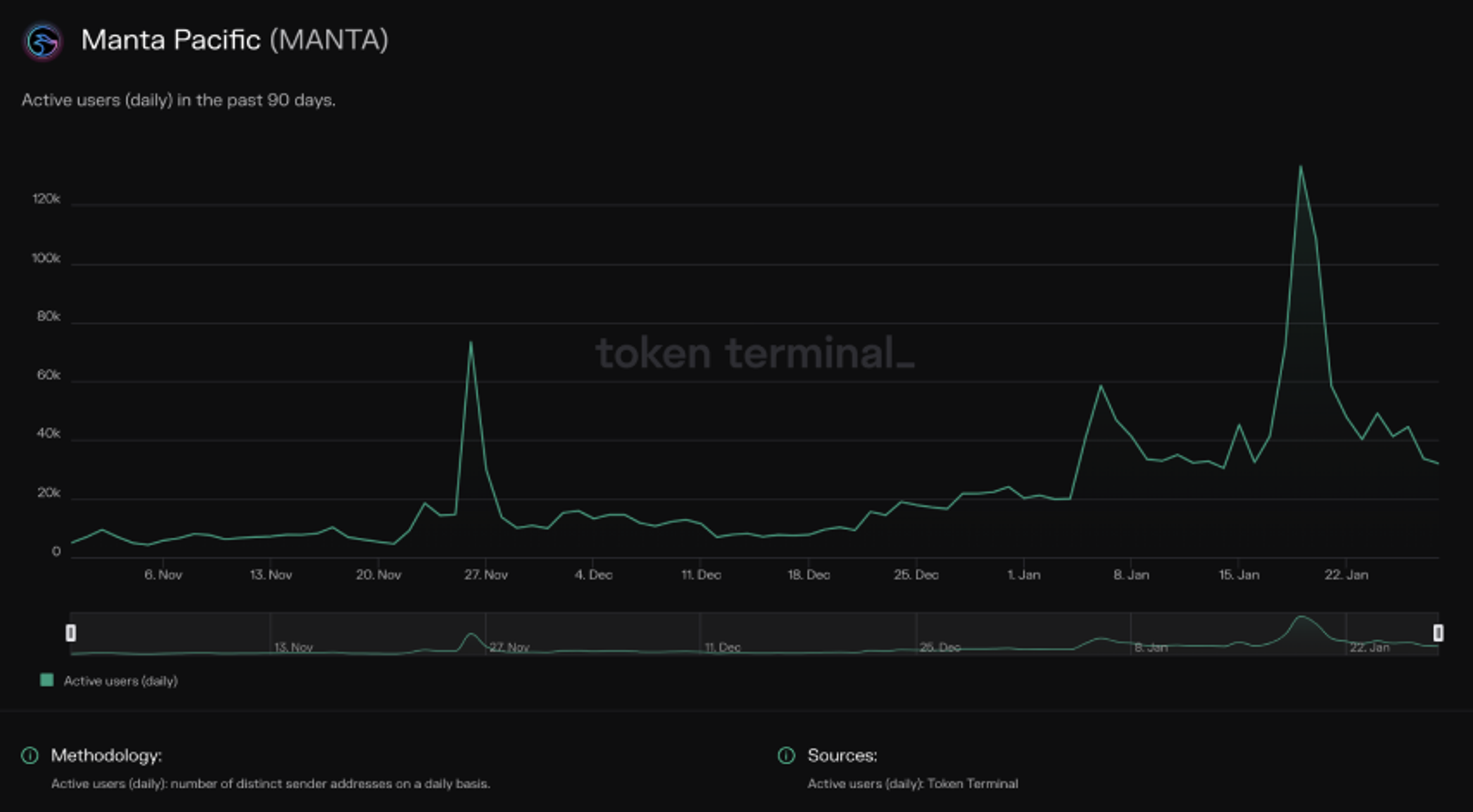

Finally, below we provide a view into active user numbers in the first few months post-launch. Note that the spike on Jan 19th is most likely due to users collecting the first airdrop as the claim period began on Jan 18th.

As a point of reference, zkSync was doing about 4x Manta's users 3 months post-launch. Base was doing 7x 3 months into the project (thanks to friend.tech). Activity has since leveled off on Base. L2s that launched in ‘21 saw much less traction early on: Arbitrum had just 5k users 3 months post-launch (avg. 164k/day in January ‘24), and Optimism had only 2.5k active users in its first few months (avg. 66k/day in January ‘24).

Looking Forward

As we’ve noted in prior L2 coverage, it’s one thing to incentivize early users with airdrops and other token incentives. But it's another thing to keep them. Time will tell if the nascent apps on Manta will be able to find long-term product-market fit when the incentives are exhausted.

And let’s not forget — if you’re an app developer you’re probably more interested in the zero-knowledge, modular infrastructure that Manta is building than the token incentives.

The product: What makes Manta unique

Kenny Li, one of the co-founders of p0x Labs (the development team behind Manta), made a very strong case for the modular tech stack in his recent interview with Oskari Tempakka from Token Terminal.

The key takeaway from Kenny was that app developers have no interest in figuring out which L2 to deploy on. They don’t know all the differences. They don’t want to know all the differences. And they certainly don’t want to deploy in multiple ecosystems, maintaining code on multiple networks. Manta is building for this future — in which the infrastructure is commoditized. That’s why they are building tools in a modular format to enable “plug and play” for web3 app developers.

Aside from the unapologetic support for modularity, we think there are five key areas to keep an eye on as it pertains to Manta from a product perspective:

- The team is solely focused on zero-knowledge technology because they believe it provides superior UX for both app developers and end users: privacy + scalability.

- Manta provides “universal circuits” for app developers — which means they don’t need to maintain code, deal with cryptography, etc. Instead, they simply tap into an existing SDK solution requiring far less code to deploy zero-knowledge solutions.

- Manta is the first L2 to deploy on Celestia, significantly reducing gas fees for app developers. These savings (over $1.4m at the time of publication) can improve the margins of L2s while also improving the user experience.

- As an Ethereum-based L2, any Ethereum-based application that can deploy on other EVMs can deploy on Manta and immediately take advantage of the lower gas fees offered via Celestia DA. As a first mover with Celestia, we are watching closely to see if this is truly a differentiating factor for app developers moving forward.

- Manta is extremely bullish on Polygon zkEVM. This is the driver of their decision to leave the OP stack as far as we can tell.

Per Kenny Li, the most exciting use cases that could be built on Manta today include 1) payroll systems, 2) games, and 3) voting systems.

Top projects building on Manta

Element, a marketplace for NFTs, collectibles, and gaming assets is seeing the most onchain activity so far, with over $140k in gas fees over the last 90 days.

Beyond Element, we see initial onchain activity coming from bridges, DEXs (DODO, iZUMI), and stablecoins.

*Please note that given the nascency of the project, there are still some unknown contracts we are seeking to label and track onchain.

User onboarding

A quick breakdown of the limited data since Manta Pacific launched the mainnet just 3 months ago:

- In September Manta onboarded 54k new users. 54% of those user wallets were still interacting with Manta’s smart contracts in December.

- In October Manta onboarded 123k new users. 39% were still interacting with the blockchain in December.

- 88k new users were onboarded in November, with 66% returning the next month.

- 216k new users onboarded in December. Please note the first token airdrop occurred on January 18.

We’ll revisit these numbers in the coming months to monitor retention post-airdrops.

Business model

Manta Pacific makes money by charging a fee to users who interact with applications built on its L2 infrastructure.

A portion of these fees is then paid to Ethereum for settlement and data availability. With that said, by leveraging Celestia for data availability, Manta can significantly reduce its costs paid to Ethereum (around 95%). These savings are passed onto users, and Manta expects its margins to remain the same or slightly improve — creating highly scalable infrastructure.

In summary:

Per Kenny Li, the team plans to recycle profits into marketing, ecosystem projects, and ecosystem growth funds.

Note that Manta will not pay fees to Polygon zkEVM initially for leveraging their CDK (Chain Development Kit) but expects to have an economic split at some point (similar to how Optimism charges Base 15% to use the OP Stack).

Token economics

Overview

The first $MANTA airdrop went live on January 18, 2024. Airdrops are claimable for 6 months.

Note that both the Manta Atlantic and Manta Pacific networks will have representation of the 1 billion tokens. As liquidity flows between the networks, the tokens will be locked and unlocked on the liquidity pool of the Celer bridge. The total unlocked tokens from both Manta Atlantic and Manta Pacific determine the current circulating supply.

- Total supply = 1,000,000,000

- Annual inflation rate = 2% (starts with token genesis)

- Token Utility: governance voting, staking (on Manta Atlantic L1), payment for gas fees on Manta Atlantic (72% accrues to ecosystem projects - incentivizing apps to build on Manta), potential future sequencer revenue from Manta Pacific L2.

Token Allocation

- New Paradigm Airdrop: 65m tokens or 6.5% - 50m released at token genesis, remaining 3 months after token genesis.

- Foundation Treasury: 135m tokens or 13.5% - linear release over 72 months.

- Ecosystem/Community: 211.9m tokens or 21.19% - 50m released at token genesis, remaining over 48 months via governance.

- Advisors: 8.10% - 81m released at token genesis, remaining over 30 months.

- Team: 10% - 18 months cliff, 48 month linear release.

- Public Investors: 8% - half released at token genesis, half on monthly releases over 6 months.

- Private Investors: 12.94% - 12 month cliff, linear release over 36 months

- Strategic Investors: 6.17% - 12-month cliff, linear release over 36 months.

- Institutional Investors: 5% - 12-month cliff, linear release over 36 months.

- Airdrops: 5.6% - fully released at token genesis.

- Binance Launchpad: 3% - fully released at token genesis.

Market Comps

A few takeaways when we observe Manta’s early performance against its more established peers:

- Manta is the first live L2 to use Celestia for data availability costs. The team has indicated that this has already saved users $1.4m. However, we aren’t seeing this just yet when we review the average cost/transaction over the last 3 months. Please note that work is currently being done to determine Manta’s margins, given they pay Ethereum only for settlement costs.

- Manta is scrappy. The team is holding its own despite having far fewer developers at this stage of the project.

- Manta’s ability to bootstrap almost half a billion in TVL in its first few months is very impressive.

- Manta is currently leading its peers in 4-month user retention. Of course, we’ll need to revisit this figure in the coming months as the haze of the first airdrop wanes.

Founding team

Kenny Li - MIT Sloan School of Management May 2020. Also was the teaching assistant for Gary Gensler’s blockchain course at MIT and has a background in cloud computing.

Shumo Chu - formerly an assistant professor at UC Santa Barbara, and System Researcher at Algorand

Victor Ji - Former research assistant at Harvard.

Per LinkedIn, p0x Labs has 17 listed employees. However, per Kenny Li’s recent conversation with Oskari Tempakka, Manta is now up to 60 employees globally — with some concentration in Turkey, China, and India.

Open Positions

4 open positions listed on its website: https://jobs.lever.co/MantaNetwork

Github Activity

As is the case with many protocols, we are observing power laws amongst code contributors within Manta Network. The vast majority of coding appears to be coming from 3-4 developers.

Generally speaking, when we review project GitHub activity, we are primarily looking for red flags — such as highly productive developers leaving the project, or periods of low coding activity. We haven’t encountered anything concerning when reviewing Manta’s GitHub.

Investors

In total, Manta has raised over $60m across 4 investment rounds.

In February of 2021, the team raised its seed round. Lead investors included well-known crypto native venture firms Multicoin Capital and Polychain Capital.

Eight months later the team raised another $5.5m from ParaFi, Coinfund, CMS Holdings, Santiago Roel, and more.

Another $28.8m was raised shortly thereafter via a public sale on the Tokensoft platform — selling 80m tokens for .$36.

Finally, in July of last year, the team raised another $25m at a $500m valuation. The lead investors were Polychain Capital and Qiming Venture Partners (China-based, strategic for the Asian market). Other backers included CoinFund, Alliance DAO, and SevenX Ventures.

Community

Twitter: 633k followers and an active

Discord: 262,944 members

Kenny Li Twitter: 36.4k followers

With the recent airdrop, we’ll be watching to see how this impacts the Manta community going forward. The wealth effect created by well-orchestrated airdrops can not only capitalize an army of new users and boost onchain liquidity, but it can create a loyal community of evangelists and organic marketing far into the future.

Conclusion

5 key takeaways:

- Manta is solely focused on building modular, scalable, zero-knowledge infrastructure for web3 applications.

- They are the first Ethereum-based rollup to leverage Celestia for data availability, saving users 750k already.

- The team appears to be quite scrappy. Manta has raised significantly less cash than its competitors ($60m vs $450m for zkSync). In some ways, we think this is a good thing. Why? It forces outside-the-box thinking. We are seeing this show up in Manta Pacific's marketing and incentive programs, which have driven a 30x increase in TVL over the last month.

- The team isn’t afraid to pivot. The decisive move to Polygon zkEVM from the OP stack is instructive in this regard.

- Kenny Li, the co-founder, and face of Manta Network — seems to have a very clear vision for how the web3 tech stack will scale, and is positioning Manta to be a leader in that process.

As ever, success will ultimately be dependent on the core team and community executing over a very long time horizon.

The authors of this content, or members, affiliates, or stakeholders of Token Terminal may be participating or are invested in protocols or tokens mentioned herein. The foregoing statement acts as a disclosure of potential conflicts of interest and is not a recommendation to purchase or invest in any token or participate in any protocol. Token Terminal does not recommend any particular course of action in relation to any token or protocol. The content herein is meant purely for educational and informational purposes only, and should not be relied upon as financial, investment, legal, tax or any other professional or other advice. None of the content and information herein is presented to induce or to attempt to induce any reader or other person to buy, sell or hold any token or participate in any protocol or enter into, or offer to enter into, any agreement for or with a view to buying or selling any token or participating in any protocol. Statements made herein (including statements of opinion, if any) are wholly generic and not tailored to take into account the personal needs and unique circumstances of any reader or any other person. Readers are strongly urged to exercise caution and have regard to their own personal needs and circumstances before making any decision to buy or sell any token or participate in any protocol. Observations and views expressed herein may be changed by Token Terminal at any time without notice. Token Terminal accepts no liability whatsoever for any losses or liabilities arising from the use of or reliance on any of this content.

Stay in the loop

Join our mailing list to get the latest insights!

Continue reading

Customer stories: Token Terminal’s Data Partnership with Linea

Through its partnership with Token Terminal, Linea turns transparency into a competitive advantage and continues to build trust with its growing community.

Introducing Tokenized Assets

Token Terminal is expanding its standardized onchain analytics to cover the rapidly growing category of tokenized real-world assets (RWAs) – starting with stablecoins, tokenized funds, and tokenized stocks.

Customer stories: Token Terminal’s Data Partnership with EigenCloud

Through its partnership with Token Terminal, EigenCloud turns transparency into a competitive advantage and continues to build trust with its growing community.