This is the seventh post in our research series. In this series, we publish data-driven analysis on specific blockchains, dapps, and market segments. Let’s dig in!

Topic: Ethereum Name Service, a decentralized domain name registry for the Ethereum ecosystem.

Ethereum Name Service (ENS) is a naming system on the Ethereum blockchain. It improves the user experience of Ethereum by connecting human-readable names to machine-readable addresses. Launched in 2017, the protocol has grown significantly and launched its own token in 2021. This article provides an overview of ENS and its historical performance using Token Terminal’s data.

Protocol overview

Memorizing crypto wallet and smart contract addresses is very difficult for most humans. ENS provides a map between human-readable names like “alice.eth” and machine-readable identifiers such as Ethereum addresses and metadata. The goal is to make the Ethereum ecosystem more accessible and enjoyable to use.

ENS is similar to the Domain Name System (DNS), a central component of the web that translates human-readable domain names such as tokenterminal.com into IP addresses. This makes it easy for people to memorize website names and navigate the web. Similarly, ENS makes it easy, for example, to memorize a friend’s wallet’s name and send tokens to it.

Like DNS, ENS operates on a system of dot-separated hierarchical names called domains. The top-level domains (e.g., .eth) are owned by the smart contracts of the ENS protocol. First-level subdomains such as “alice.eth” can be bought by anyone and are owned by the buyer for as long as they keep paying ENS’s fees. Importantly, second-level subdomains are owned by the owner of the first-level subdomain. For example, the owner of “alice.eth” also owns “pay.alice.eth” and all other subdomains. This is similar to how DNS works. For example, docs.tokenterminal.com is a subdomain of tokenterminal.com. The root node is owned by a multisig contract controlled by a group of senior members of ENS and related projects.

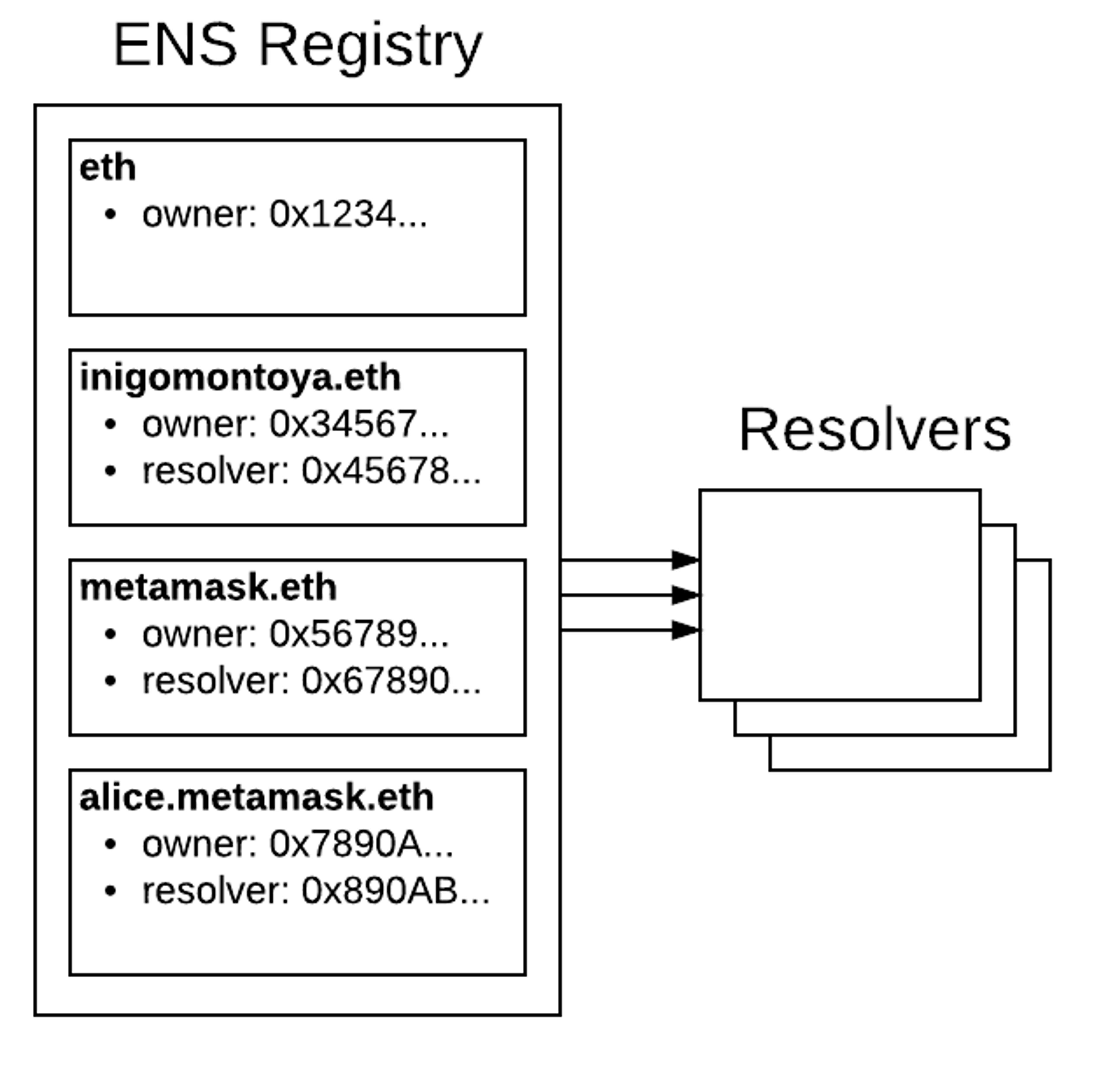

At the technical level, the ENS protocol consists of two main components: the ENS registry and resolvers.

The ENS registry is a smart contract that maintains a list of registered domains and subdomains. Resolvers are smart contracts that translate the human-readable names into addresses. While ENS controls the registry, any contract implementing the required standard can act as a resolver. At the contract level, human-readable names are converted to fixed length cryptographic hashes. Importantly, ENS also supports reverse resolution that finds the ENS name corresponding to a given address.

ENS generates revenue by charging fees. Shorter names are more rare and cost more. Names that are five characters or longer cost 5 USD per year, names with four character or more cost 160 USD per year, and names with three characters cost 640 USD per year. The fees are defined in USD but paid in ETH. The exchange rate between ETH and USD is set by the Chainlink oracle. The fees are stored in the root node’s multisig contract. Names can not be revoked after issuance as long as an active registration is maintained.

ENS’s development is managed by True Names LTD, a company based in Singapore. The ENS protocol is governed by the ENS decentralized autonomous organization (DAO), launched in November 2021. ENS DAO is represented by a real-world legal entity as a Cayman Islands Foundation. ENS DAO’s governance token is ENS that was launched at the same time as the DAO. The total supply of ENS is 100 million. At launch, 50% of the supply was stored in the DAO treasury, 25% of the total supply was distributed to the users of ENS in an airdrop, and 25% was distributed to the contributors. The airdropped tokens were made available immediately but other tokens are vested for 4 years, meaning that the maximum supply of 100 million ENS will be in circulation in November 2025. The figure below illustrates the distribution of ENS.

Business case

Improving the user experience of blockchain technology is required for its mass adoption. ENS has developed and deployed a useful tool that makes navigating the Ethereum blockchain easier and more convenient for humans. It has established itself as an important piece of the wider Ethereum ecosystem and is generating significant revenue. By allowing its users to sell their own subdomains, ENS also enables its users to build businesses on top of their protocol. Given the revenue that ENS is generating, on-chain competition will undoubtedly arise on Ethereum and other blockchains. However, ENS enjoys a first-mover advantage and strong brand recognition.

Historical performance

The figure below shows ENS’s total daily revenue over time. The overall trend in revenue has been consistent growth. ENS’s average daily revenue was 5k USD in 2020, 40k USD in 2021, and 100k in 2022 so far. During peak activity, ENS’s daily revenue has exceeded 1 million USD in 2022.

ENS’s revenue consists of fees paid for registering new domains and renewing existing ones. The figure below shows the composition of ENS’s revenue over time. We can see that the proportion of revenue coming from new registrations has grown over time. This reflects a growth in ENS’s user base that can lead to more consistent revenue in the future.

The price of the ENS token since its launch is shown in the figure below. After the initial attention ENS received for the airdrop, the price of the token has been on a downward trend.

Finally, the figure below shows the number of wallets holding ENS since its launch. The number of tokenholders increased until the end of 2022 as the eligible users claimed their share of the airdrop and tokens were sold.

Roadmap

After successfully launching the protocol in 2017 and the DAO, its governance token, and the corresponding legal entity in 2021, the project’s focus is on establishing consistent growth. Growth can be achieved by increasing the number of decentralized application (dapp) integrations and bringing in more users. Improvements to the protocol are actively discussed on the governance forum.

Conclusion

ENS has established itself as a central part of the Ethereum ecosystem. Despite impressive growth in revenue since its launch, there is much more room to grow as the recognition of ENS grows and it becomes more integrated with dapps on Ethereum.

The authors of this content, or members, affiliates, or stakeholders of Token Terminal may be participating or are invested in protocols or tokens mentioned herein. The foregoing statement acts as a disclosure of potential conflicts of interest and is not a recommendation to purchase or invest in any token or participate in any protocol. Token Terminal does not recommend any particular course of action in relation to any token or protocol. The content herein is meant purely for educational and informational purposes only, and should not be relied upon as financial, investment, legal, tax or any other professional or other advice. None of the content and information herein is presented to induce or to attempt to induce any reader or other person to buy, sell or hold any token or participate in any protocol or enter into, or offer to enter into, any agreement for or with a view to buying or selling any token or participating in any protocol. Statements made herein (including statements of opinion, if any) are wholly generic and not tailored to take into account the personal needs and unique circumstances of any reader or any other person. Readers are strongly urged to exercise caution and have regard to their own personal needs and circumstances before making any decision to buy or sell any token or participate in any protocol. Observations and views expressed herein may be changed by Token Terminal at any time without notice. Token Terminal accepts no liability whatsoever for any losses or liabilities arising from the use of or reliance on any of this content.

Stay in the loop

Join our mailing list to get the latest insights!

Continue reading

Customer stories: Token Terminal’s Data Partnership with Linea

Through its partnership with Token Terminal, Linea turns transparency into a competitive advantage and continues to build trust with its growing community.

Introducing Tokenized Assets

Token Terminal is expanding its standardized onchain analytics to cover the rapidly growing category of tokenized real-world assets (RWAs) – starting with stablecoins, tokenized funds, and tokenized stocks.

Customer stories: Token Terminal’s Data Partnership with EigenCloud

Through its partnership with Token Terminal, EigenCloud turns transparency into a competitive advantage and continues to build trust with its growing community.