We had the pleasure of welcoming the team from Alchemist — one of our recent listings — to join us for an AMA session on the Token Terminal Discord server.

Below is a recap of the 1-hour discussion where the floor was open for questions about both Alchemist and the data on Token Terminal (edited for clarity).

Q: Before we start, could you give a quick intro to Alchemist?

Alchemist is a community-driven builders hub and incubator, working with like-minded developers to finance, incubate, and empower small agile teams; building products that promote a fairer and more transparent crypto ecosystem whilst growing the Alchemist community.

Some popular Alchemist projects include Copper, the platform for open, transparent, and user-friendly participation in Balancer Liquidity Bootstrapping Pools, mistX, the MEV protected exchange aggregator, and Crucible, the smart contract, non-custodial, staking wallet, and NFT.

Alchemist was started with a single tweet from the @thegostep last February, including a link to a GitHub. In the beginning, there was no plan, just an emoji: ⚗

Q: Before we dive into the fundamentals, it would make sense to briefly explain how we at Token Terminal view Alchemists business

We view Alchemist as similar to a traditional company with multiple business lines, on which we provide data for the key financial metrics. Token Terminal currently tracks mistX, Copper, and Crucible as those are the Alchemist products generating revenue.

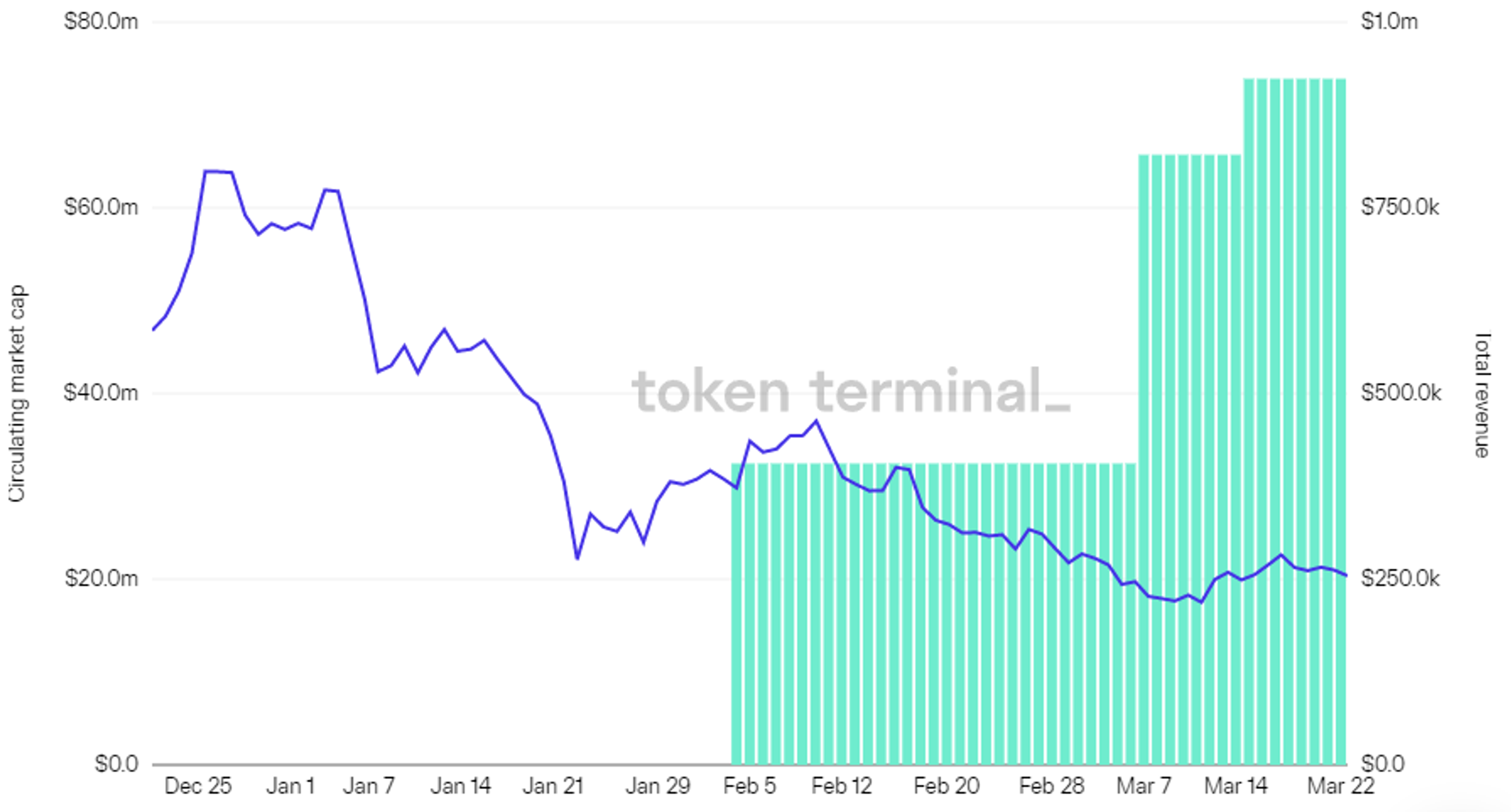

NOTE: As Alchemist's products and contracts are evolving at a high speed, we worked with their team & community to come up with a model where we're able to track the aggregate revenue from all Alchemists products for the initial listing on our platform. The tradeoff is that we can only include data from January 2022 onwards. More granular data will be added to the dashboard in the near future!

Q: Diving into Alchemist’s business, there is quite a bit to unpack here with the four core components (mistX, Crucible, Copper, and Sandwiched). Could you walk us through each of these products in more detail?

mistX is a DEX that allows users to swap on Ethereum with MEV/front-running protection and benefit from other key features such as instant ETH cashback, no cost on failed transactions, and free cancellations. One area the team focuses their efforts on is the user experience - from landing all the way to executing a trade. Instead of just using the same interface many out there use the team really crafted a unique design with an intuitive user-first approach.

Copper is a platform built on top of Balancer Liquidity Bootstrapping Pools (LBP) that allows projects to generate liquidity fairly, transparently, and with no middlemen or gatekeepers.

Crucible is a super special NFT that functions as a smart wallet. Currently, the Crucible's core functionality allows users to stake tokens located inside of their NFT smart wallet in a non-custodial fashion. The Crucible also has dynamic/generative art capabilities making it look absolutely amazing, as it is a 3D NFT!

Q: How does one mint a crucible? And out of interest, is it possible to mint only the art or does it always function as a smart vault too - or vice versa?

There are different tiers for minting. You can mint one solely for its functionality or mint with an extra fee and unlock the artwork. The utility of the Crucible is at its forefront.

The art was developed by the Crucible's in-house creative team after the initial utility and now both the utility and the creative aspect of the Crucible are being further developed in tandem.

Q: Moving on to community engagement, it appears you have a funding program for projects that add value to the Alchemist ecosystem. Do you want to say a few words about how it works and who it’s for?

The Alchemist incubator is a service for founders and builders looking to build out and grow their ideas and projects into products. Proposals are submitted via Discord to the Alchemist Council and are analyzed using an ROI-based approach to consider how Alchemist could best assist them and the value that they’ll add to the ecosystem. There’s no limit to the level of funding that projects can receive.

We also often sponsor smaller projects from within the community.

Also, just to be clear, ALL of our projects so far took their start from within the community. The community and support within the community that we have at Alchemist for the projects and those working on them, is second to none.

We would also like to shout out Alchemist Radio (100% community-run within our Discord) as it is one of our favorite parts of our community.

Q: Next I'd like to dive into fundamentals. On Token Terminal, we showcase the aggregated revenues from all of Alchemist’s products. Could you break down how each of your products generates revenue?

mistX charges a per trade fee for its MEV protection service. The Crucible charges a per mint fee as well as dropping new NFT traits (which are NFTs themselves), and Copper charges a platform access fee for all LBPs created through our user interface.

Q: How come the dashboard shows Alchemist only generating revenue around once a month?

The revenue displayed on Token Terminal is actually revenue distribution events. Right now our contracts are evolving so quickly that the way we aggregate revenues for Token Terminal is by sending them from all of our products to a single wallet that Token Terminal tracks. Because we are an incubator it will be easiest to perform such an aggregation. Currently, that process is still manual so that's why you'll see it happen once in a while, but we're now also building out functionality to directly stream revenues there as they happen.

Token Terminal: The revenue is currently distributed on a monthly basis (plus some ad hoc distributions e.g. we added an Arbitrum distribution that happened on the 15th of March). This system is in place to help us adapt to the fast development pace of Alchemists products!

Q: How do you decide how the revenues are invested? How do you approach this subject?

We have a few elements at play. The incubator sourcing teams bring up their applications to the Alchemist Council which is a community elected body that decides how to utilize MIST inflation to support projects. So the product revenue utilization is voted on by the community.

Q: Are there any financial metrics that you are focusing on optimizing at the moment?

Yes. The council works with each team to set their KPIs.

Q: What is the role of $MIST in the Alchemist ecosystem?

MIST is used to fund new ventures for the purpose of the ventures accruing value back to MIST holders through revenue airdrops or more generally utility-driven to MIST.

Q: How do you see the competitive landscape for the different Alchemist products? What are you doing differently from the main competitors?

I think our success can be summed up by us focusing on tackling very specific customer problems, leveraging our community to then further study and receive active feedback as we're building out our products, innovating on the user interface side of things, and being motivated to take things to revenue generation in a reasonable time frame because we have a reflexive relationship with the community.

All of these factors result in a very agile and MVP-driven building cycle. We’ve had to hustle as we didn't have the cushion of VC funding to take things to market, so we built out some extremely successful products in a matter of months.

The AMA concluded. We look forward to hosting more AMAs in the future.

Make sure to check out Alchemist on Token Terminal and join our Discord to participate in future AMAs: discord.gg/tokenterminal

The authors of this content, or members, affiliates, or stakeholders of Token Terminal may be participating or are invested in protocols or tokens mentioned herein. The foregoing statement acts as a disclosure of potential conflicts of interest and is not a recommendation to purchase or invest in any token or participate in any protocol. Token Terminal does not recommend any particular course of action in relation to any token or protocol. The content herein is meant purely for educational and informational purposes only, and should not be relied upon as financial, investment, legal, tax or any other professional or other advice. None of the content and information herein is presented to induce or to attempt to induce any reader or other person to buy, sell or hold any token or participate in any protocol or enter into, or offer to enter into, any agreement for or with a view to buying or selling any token or participating in any protocol. Statements made herein (including statements of opinion, if any) are wholly generic and not tailored to take into account the personal needs and unique circumstances of any reader or any other person. Readers are strongly urged to exercise caution and have regard to their own personal needs and circumstances before making any decision to buy or sell any token or participate in any protocol. Observations and views expressed herein may be changed by Token Terminal at any time without notice. Token Terminal accepts no liability whatsoever for any losses or liabilities arising from the use of or reliance on any of this content.

Stay in the loop

Join our mailing list to get the latest insights!

Continue reading

Customer stories: Token Terminal’s Data Partnership with Linea

Through its partnership with Token Terminal, Linea turns transparency into a competitive advantage and continues to build trust with its growing community.

Introducing Tokenized Assets

Token Terminal is expanding its standardized onchain analytics to cover the rapidly growing category of tokenized real-world assets (RWAs) – starting with stablecoins, tokenized funds, and tokenized stocks.

Customer stories: Token Terminal’s Data Partnership with EigenCloud

Through its partnership with Token Terminal, EigenCloud turns transparency into a competitive advantage and continues to build trust with its growing community.